August 11, 2025

SF: August 2025 Market Stats

By Compass

"San Francisco has had its share of tech companies since the dot-com boom, but the money pouring into artificial intelligence has lately supercharged the city's tech profile...Last year, [SF companies] raised nearly $35 billion [in venture capital funding]...The change is visible. Rents are climbing again. City buses are filling back up. And the face of San Francisco is starting to look younger...The city is the tech industry's hub for artificial intelligence." "What if San Francisco is the new Silicon Valley?" -The New York Times, 8/4/25

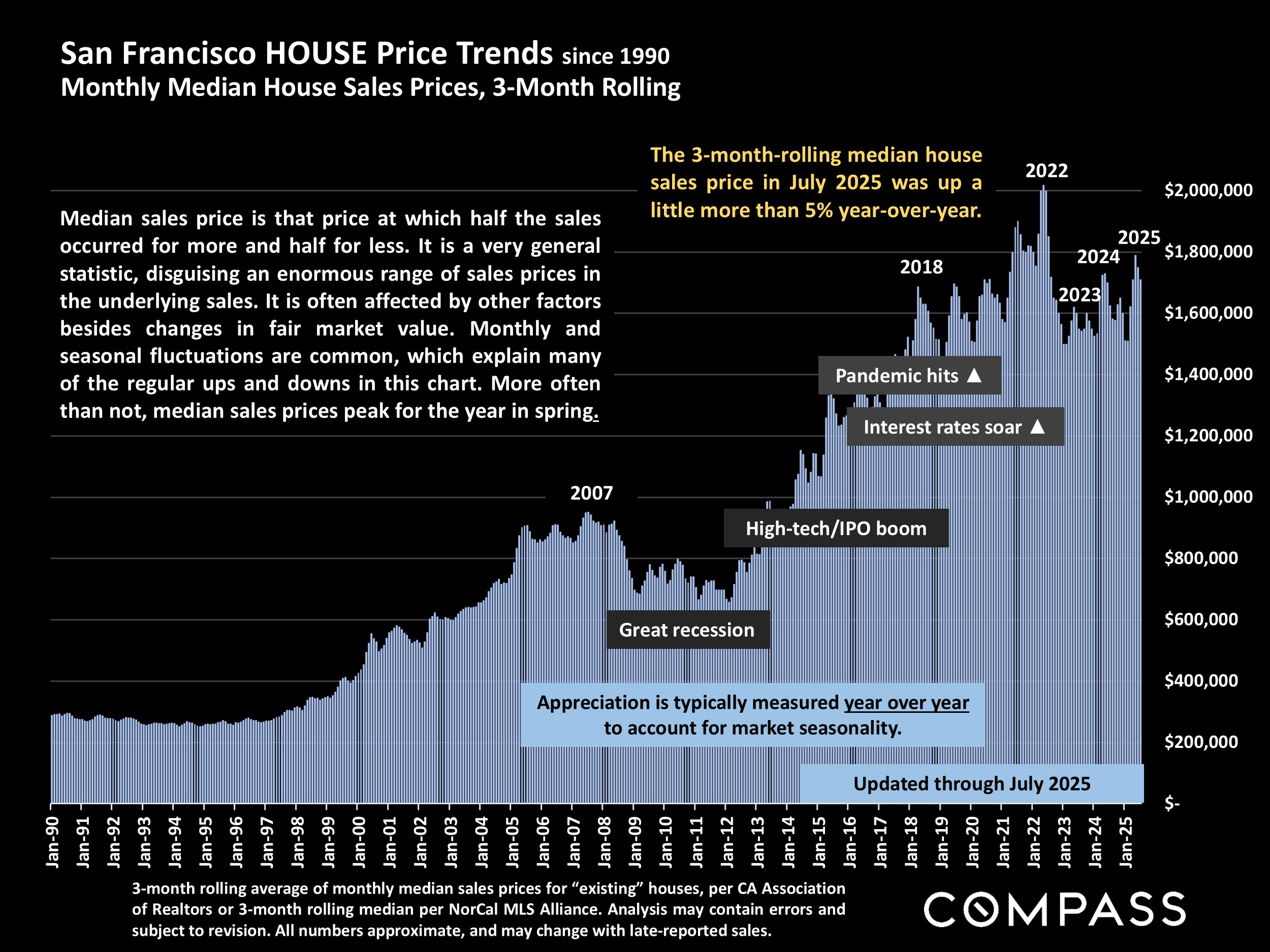

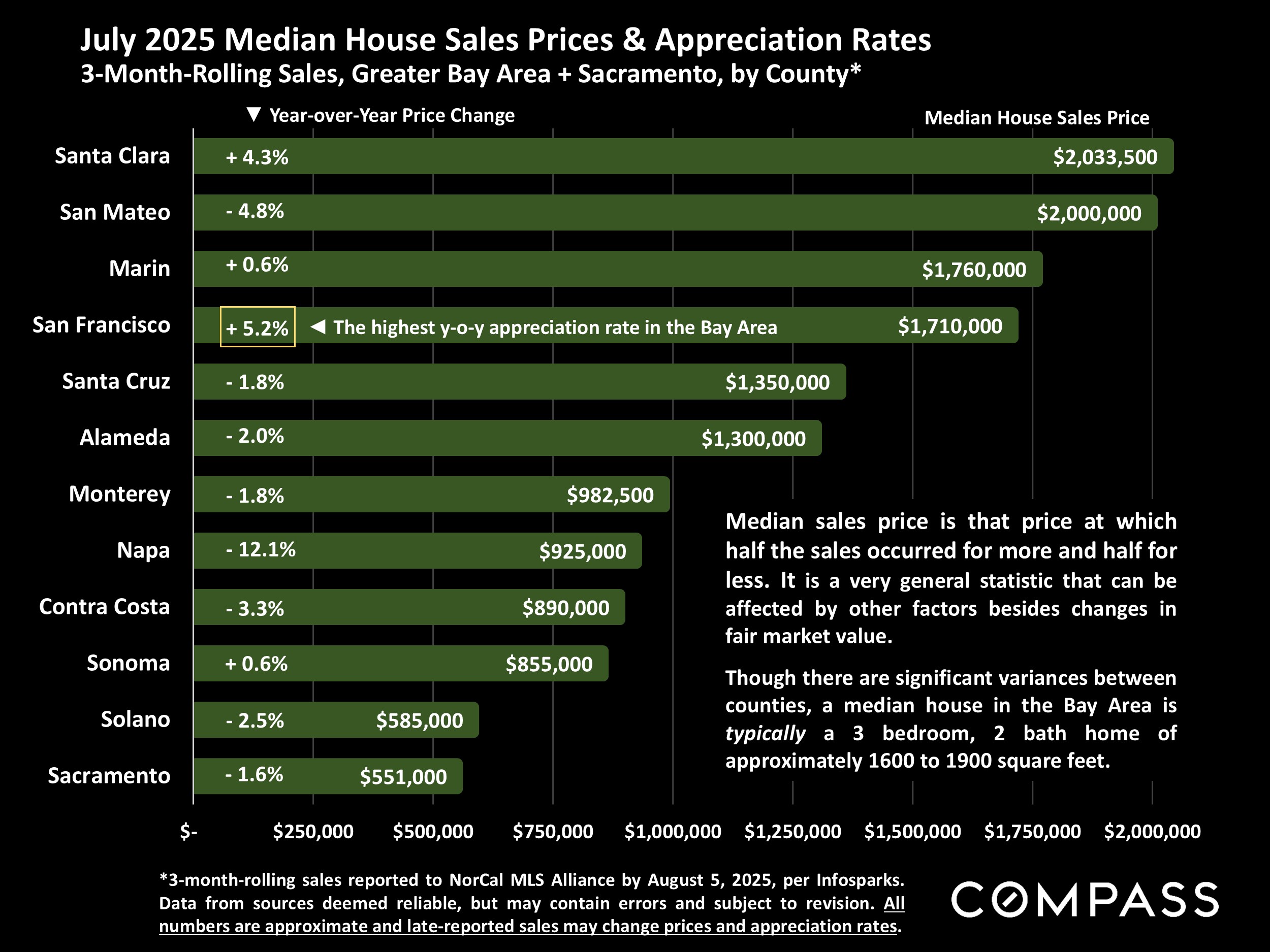

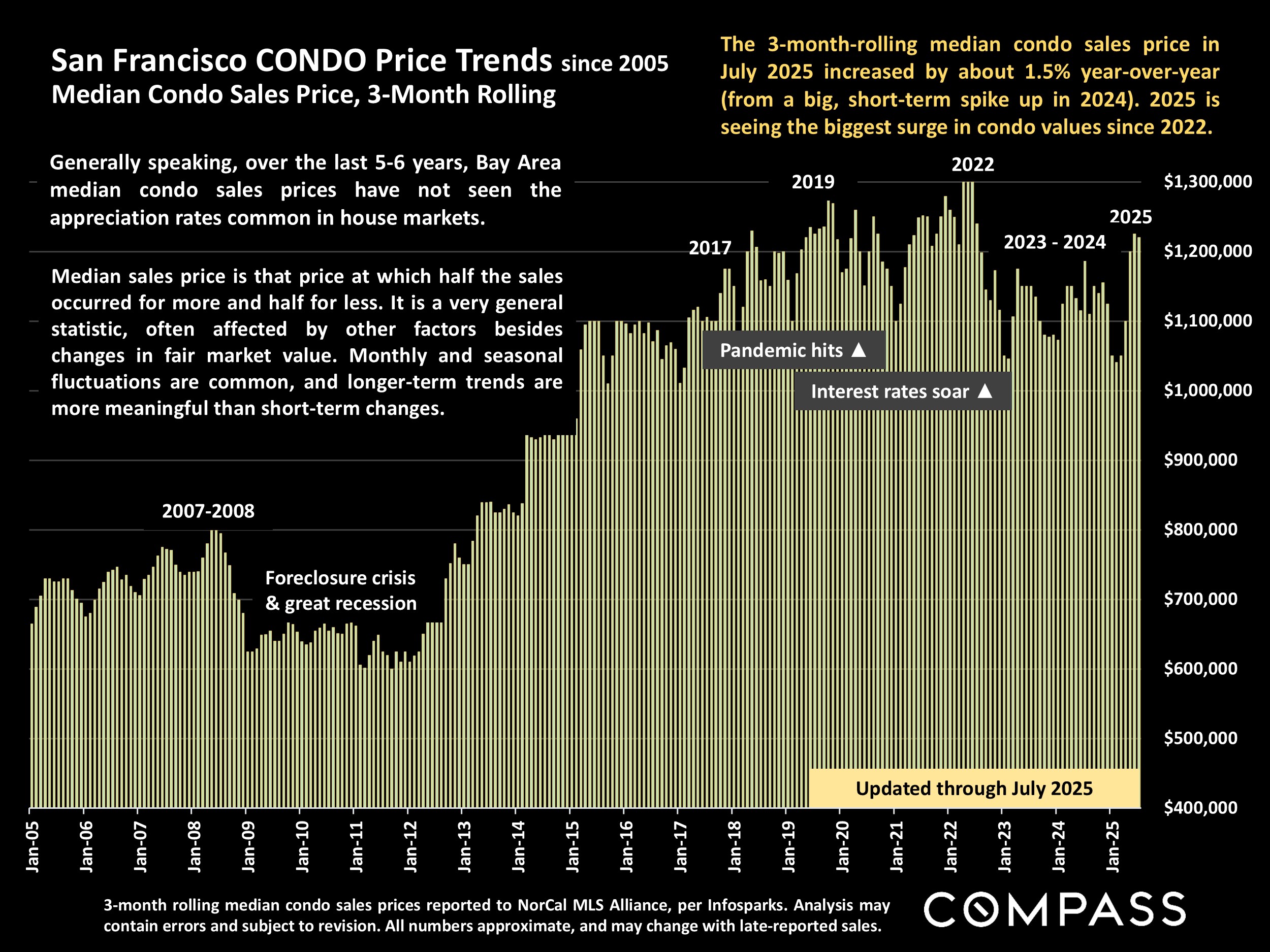

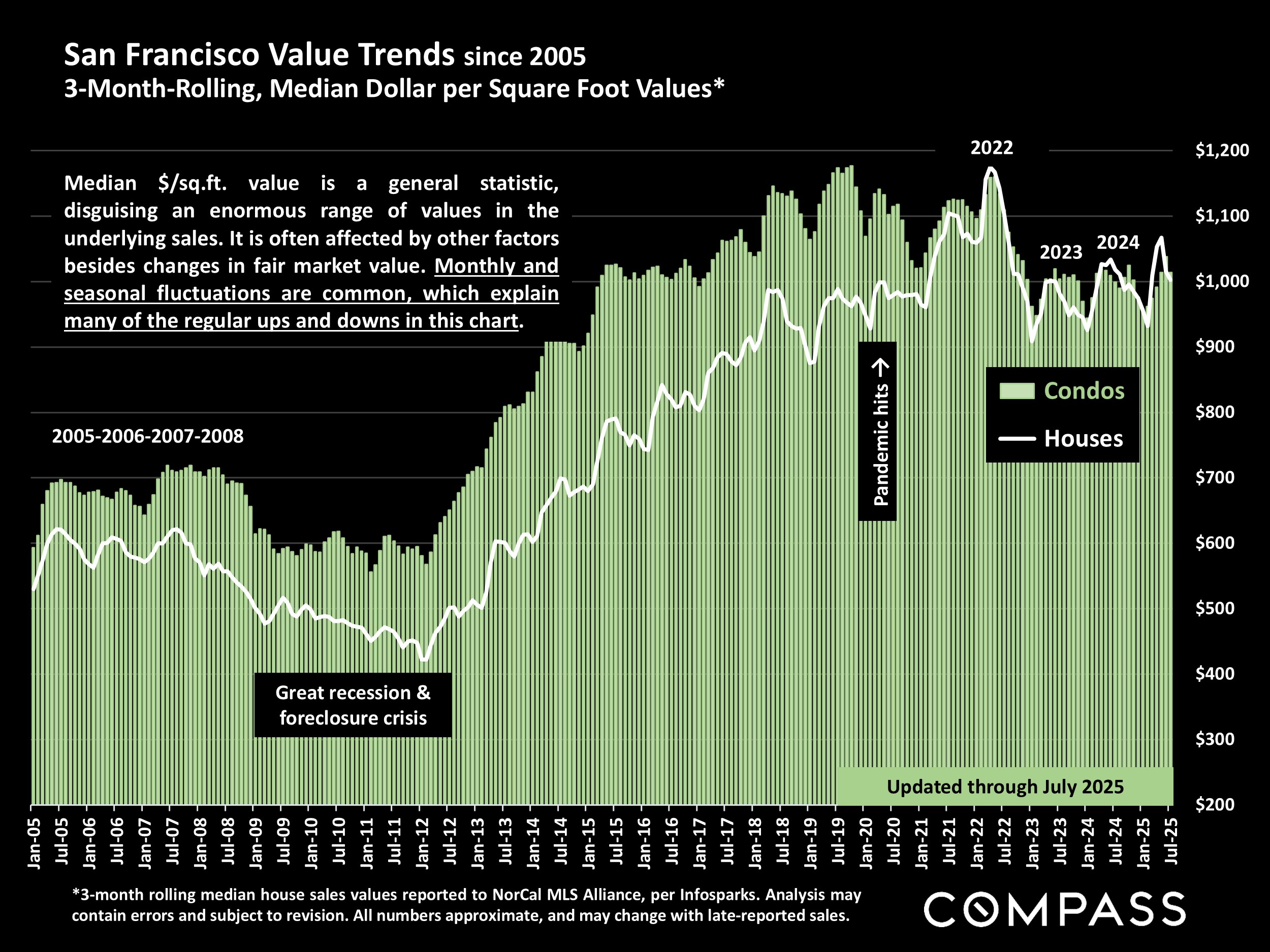

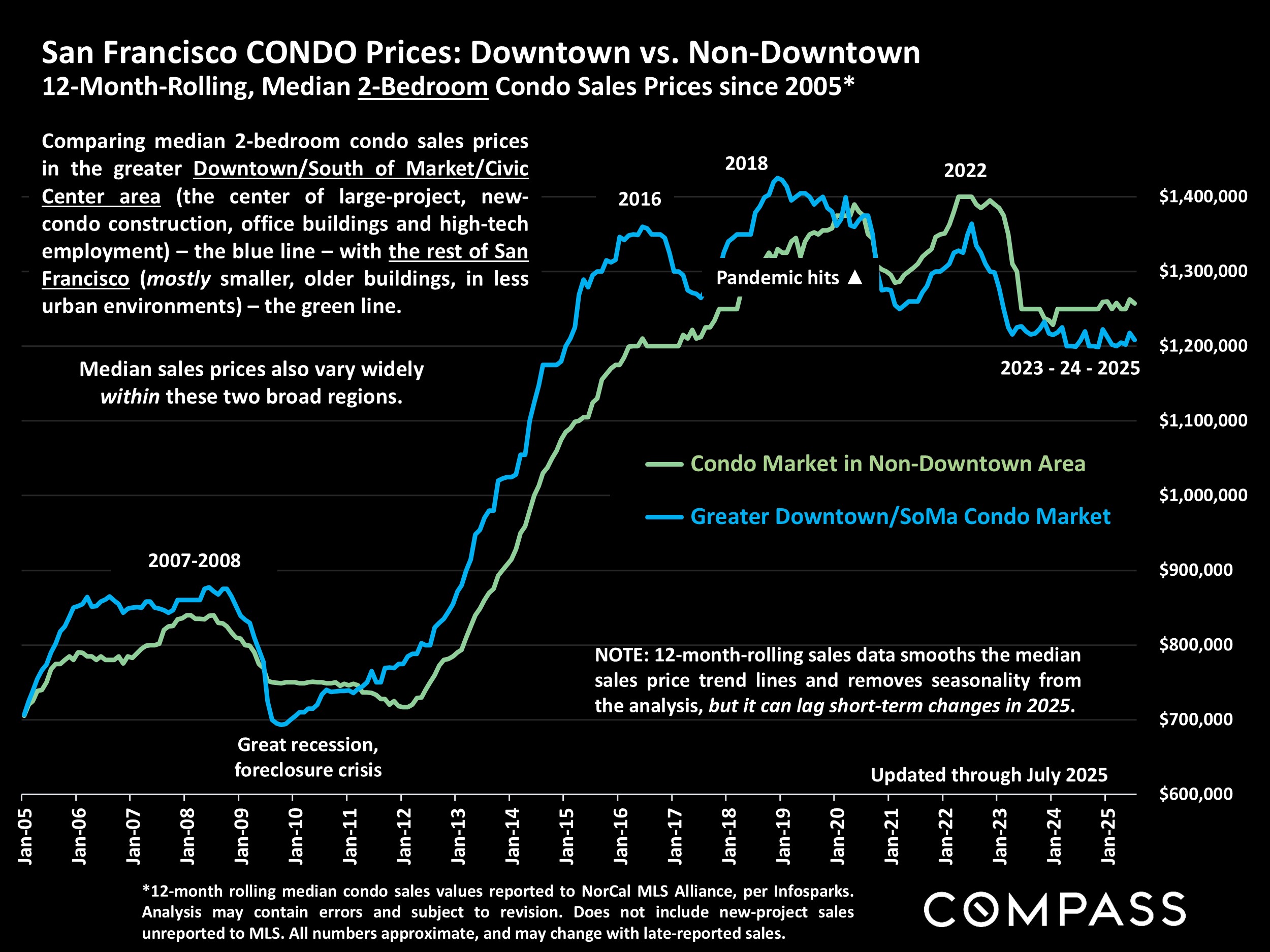

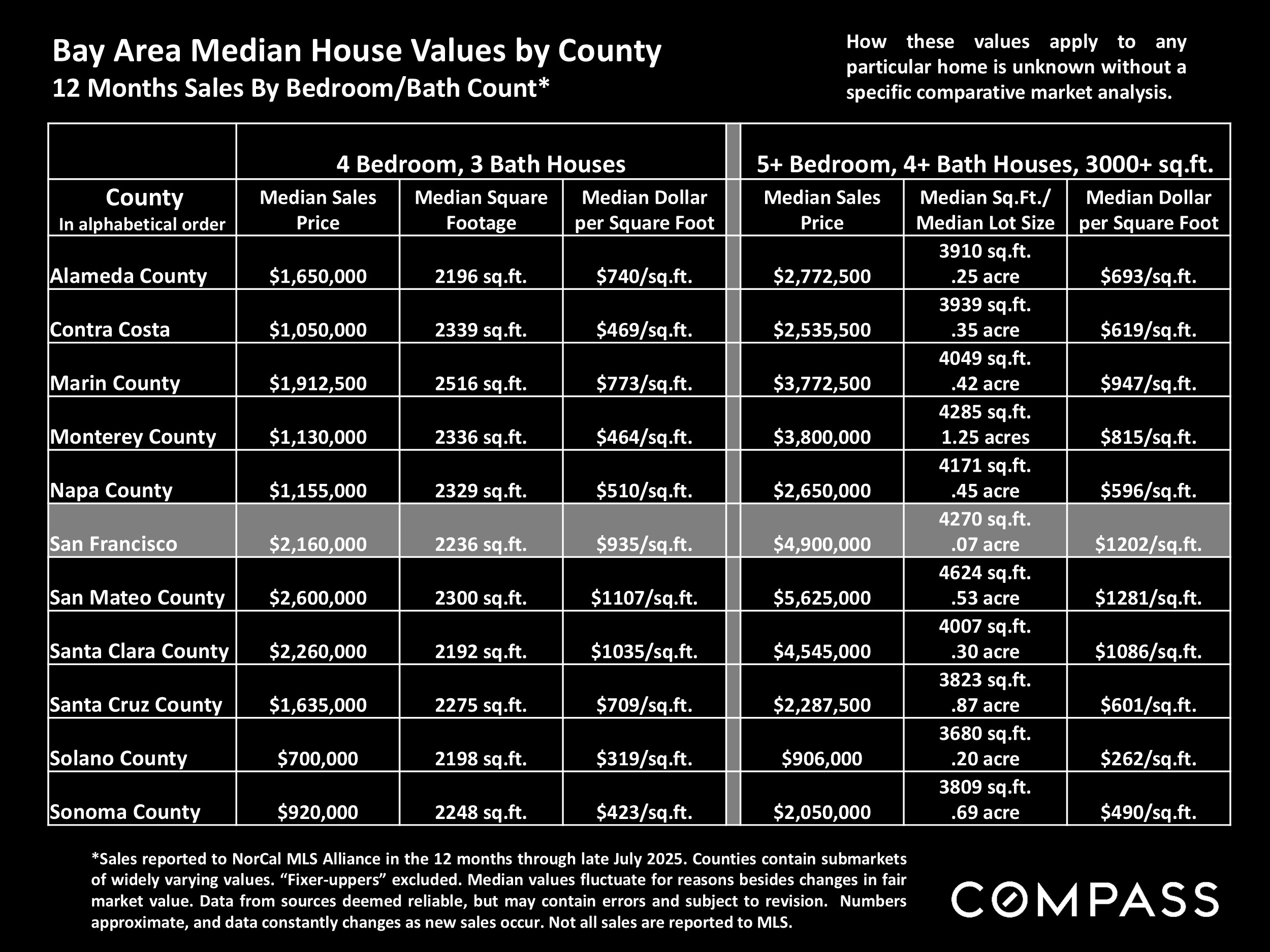

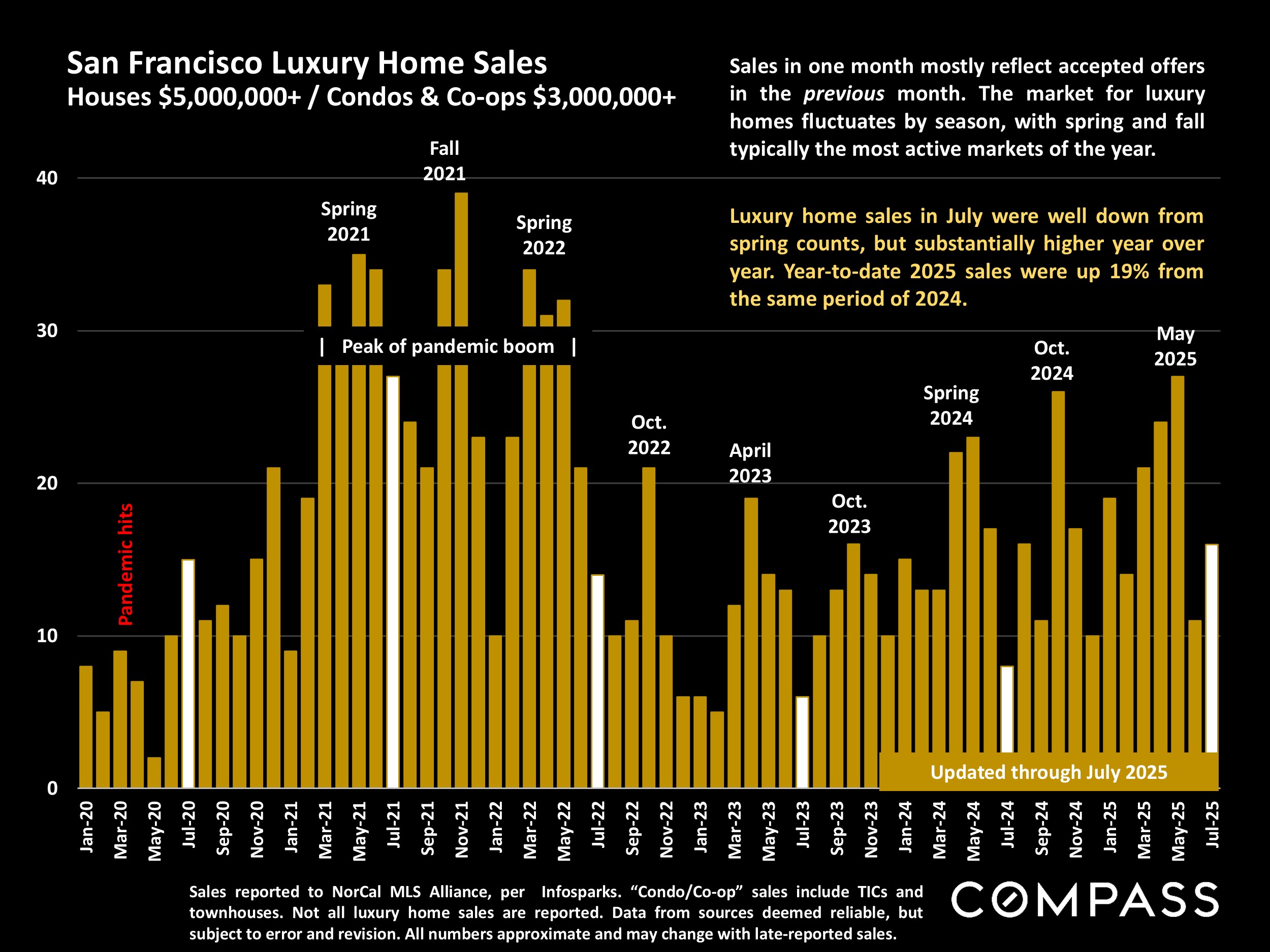

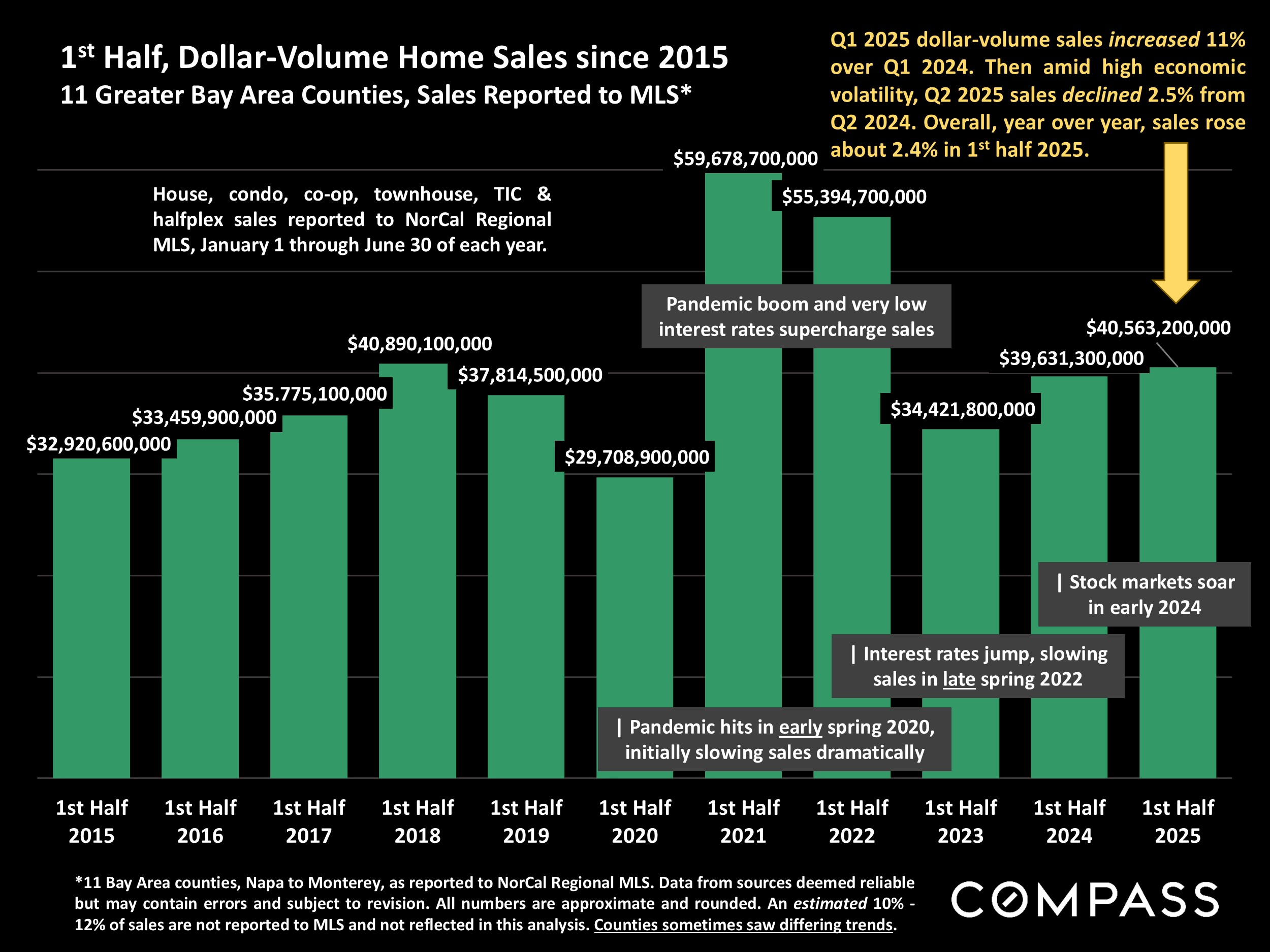

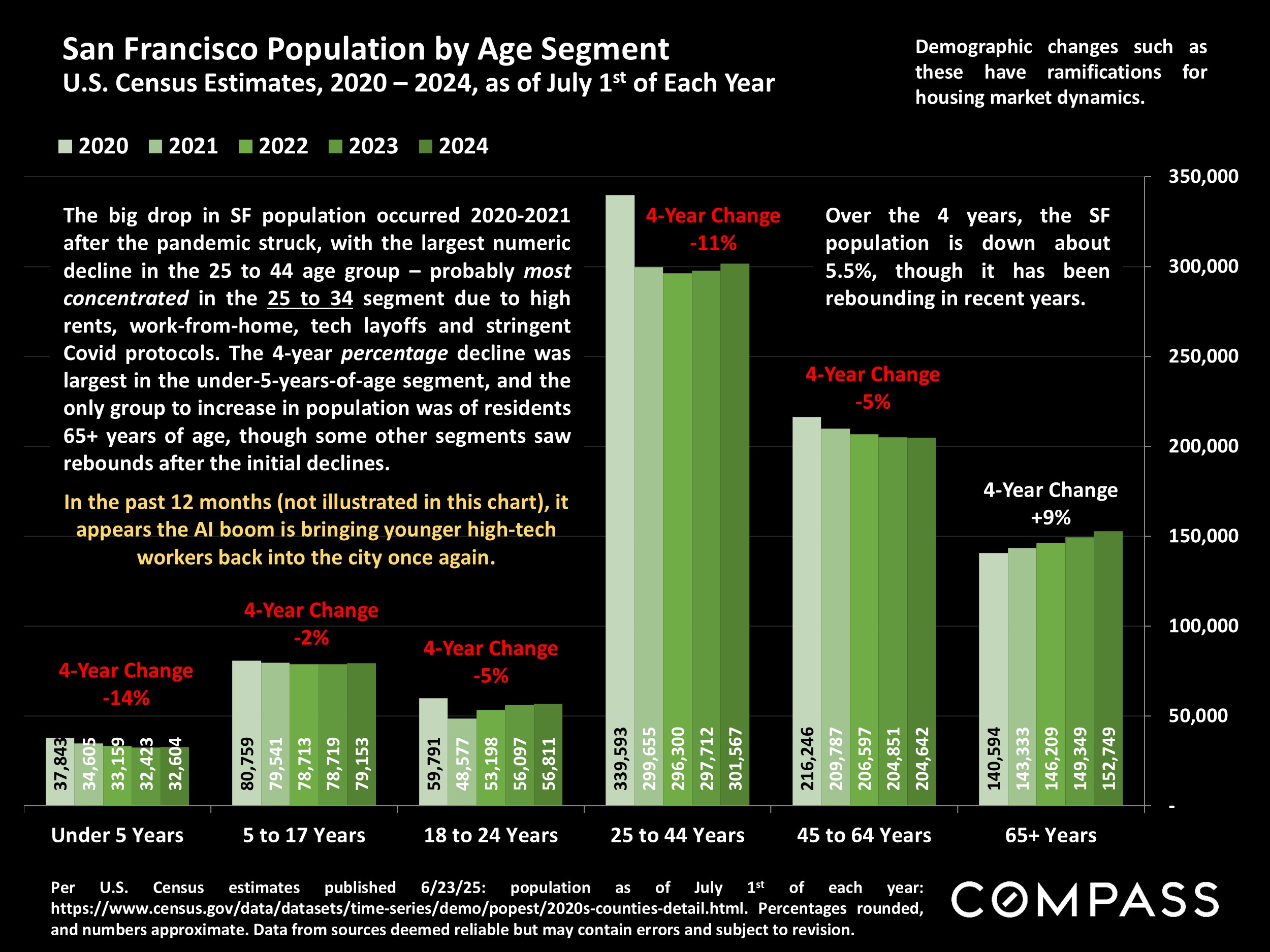

Over the past couple of years, the Al boom has most dramatically affected the housing markets in Silicon Valley, with their established players like Nvidia. San Francisco, though home to major Al firms like OpenAl and Anthropic, has been affected, but much more modestly - but that is now rapidly changing. The Al industry is exploding in the city, with dozens of new startups making San Francisco their home, and the city has become a powerful magnet for those eager to participate in perhaps the biggest technological/economic revolution of our times. Just as in the dotcom and recent high-tech booms, they are doing so due to the network effect, i.e., the tremendously dynamic synergies of being within a half mile - or even a hundred yards - of each other. That is a huge plus for the best and the brightest flocking to Al, for companies growing fast, and for the intense cross-fertilization of ideas characterizing the industry.

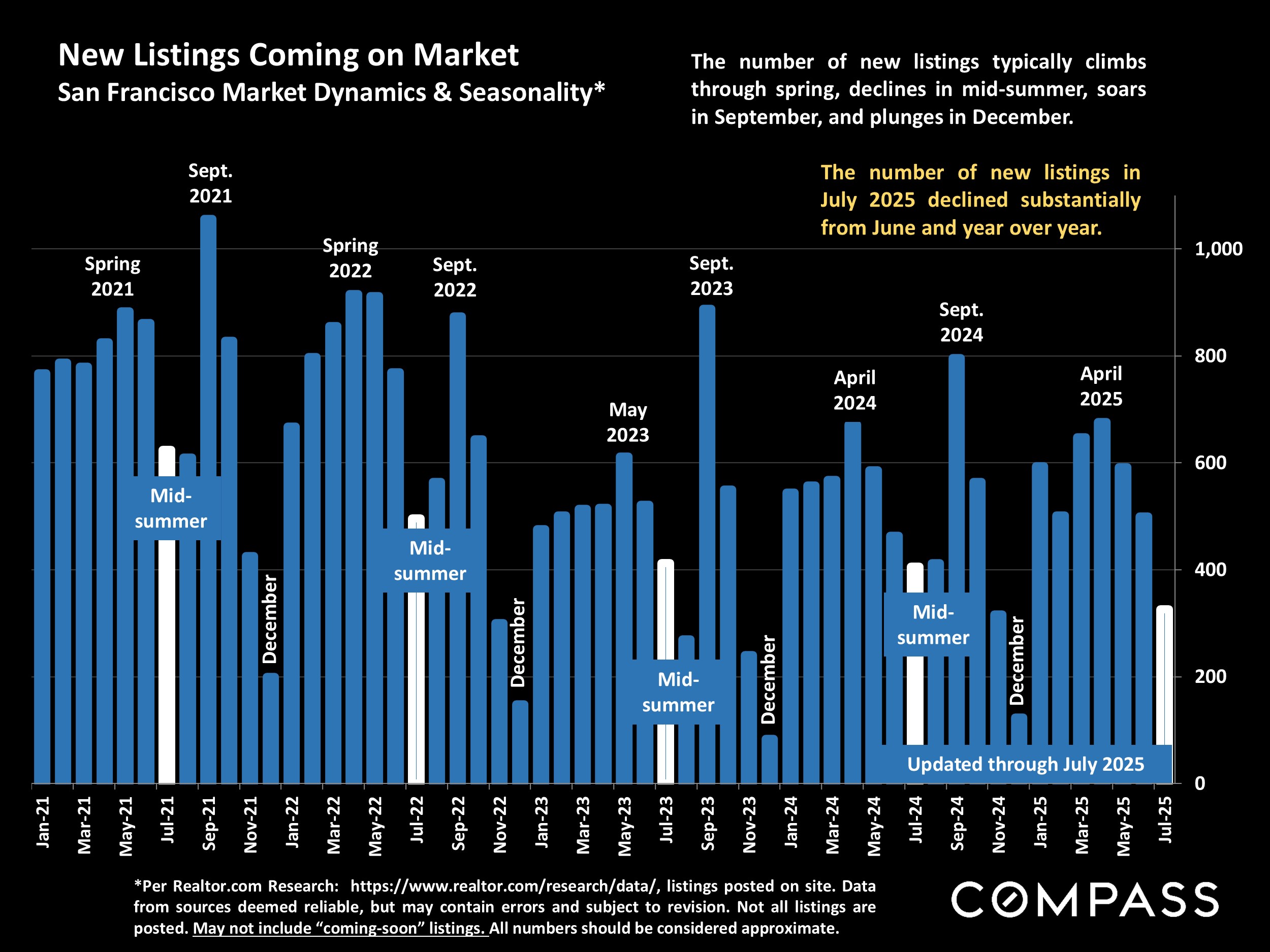

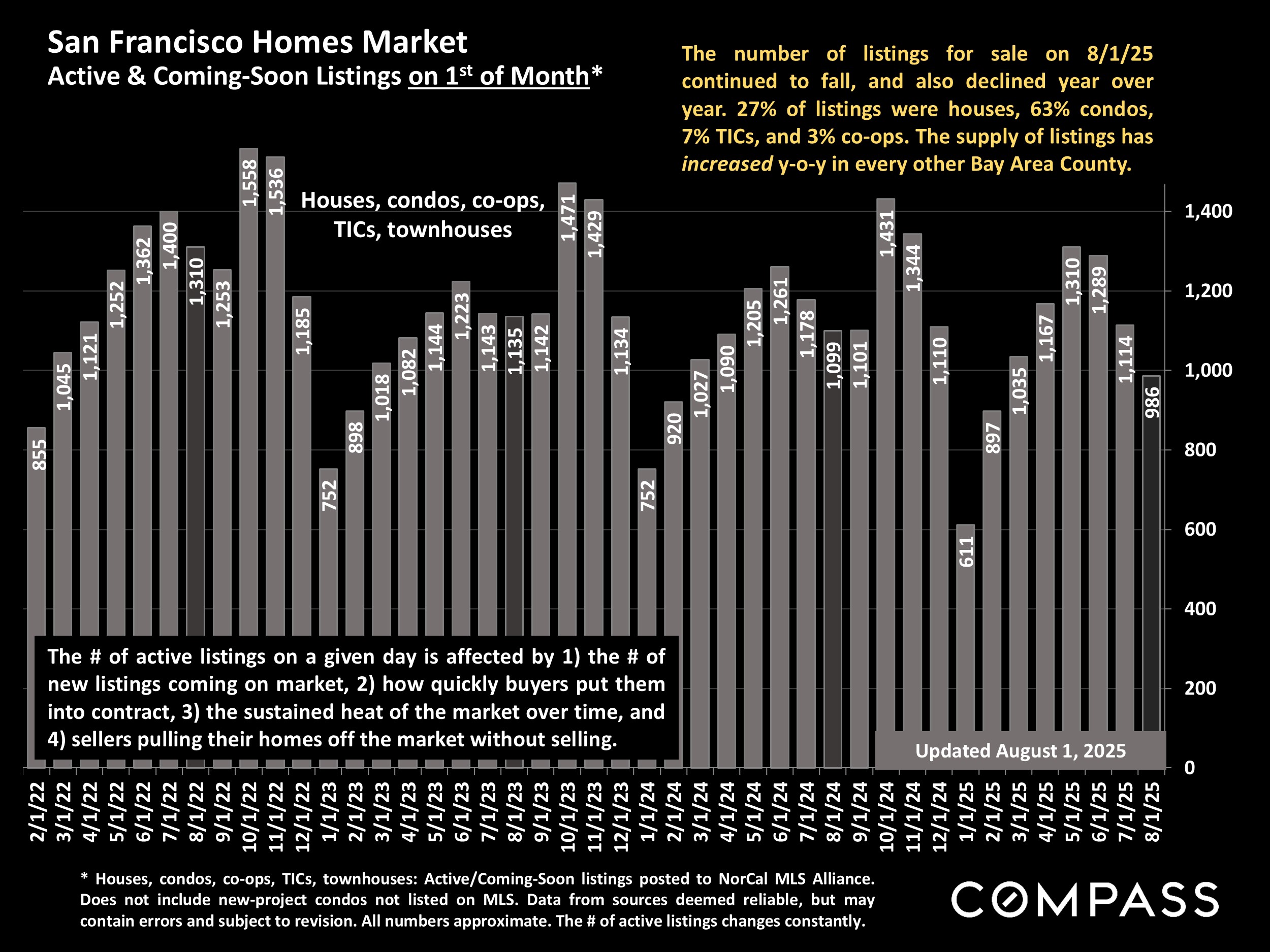

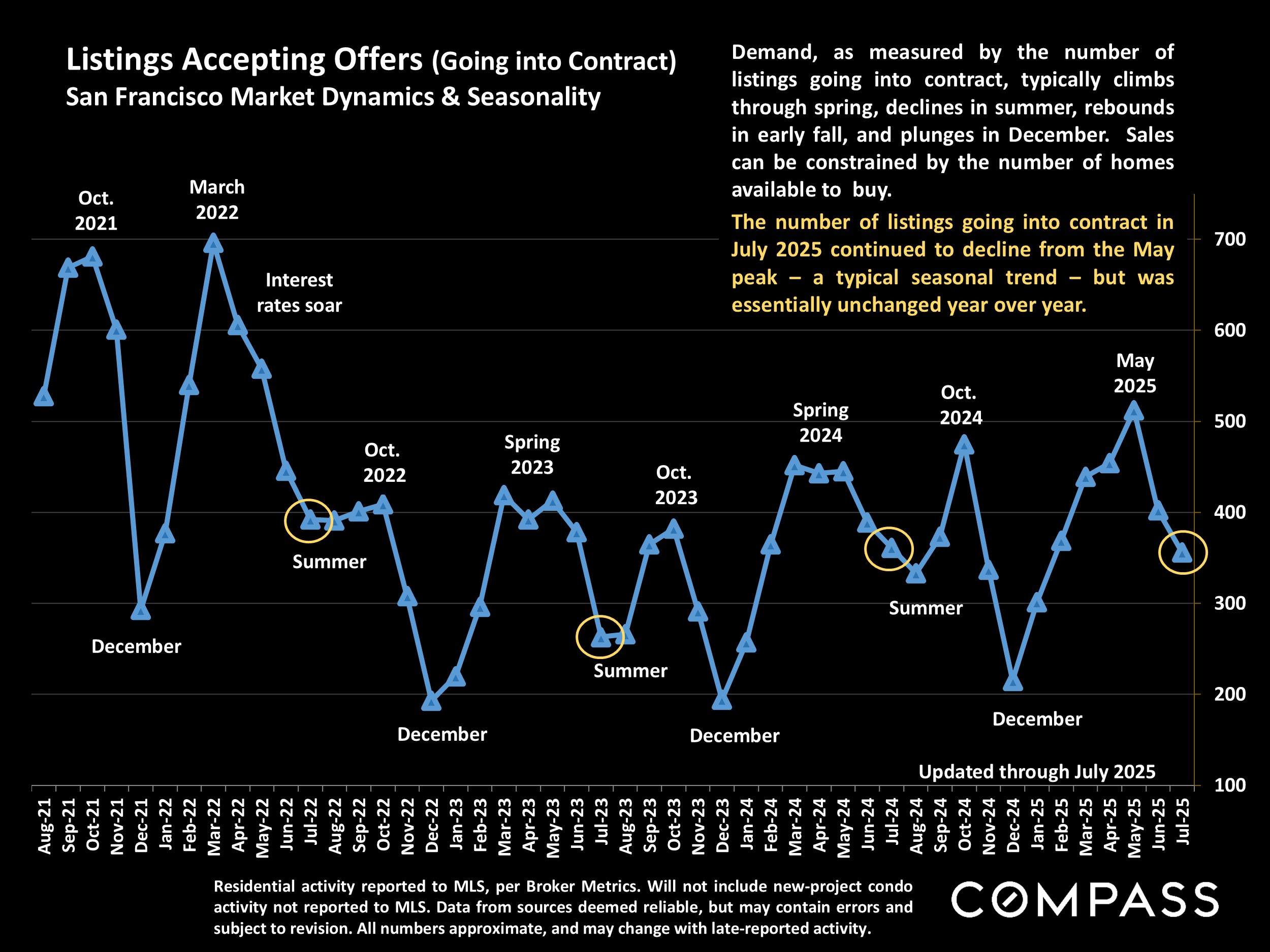

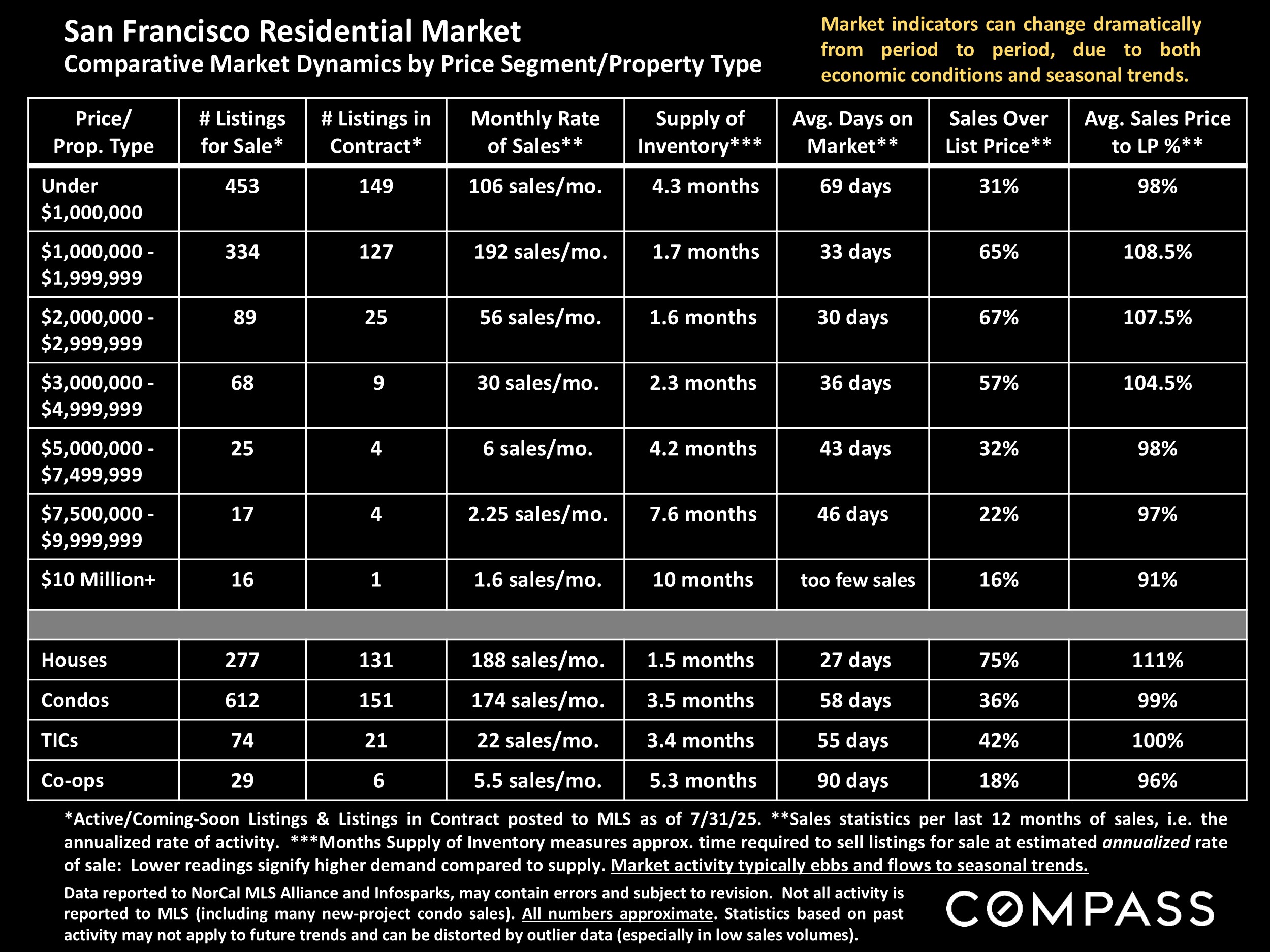

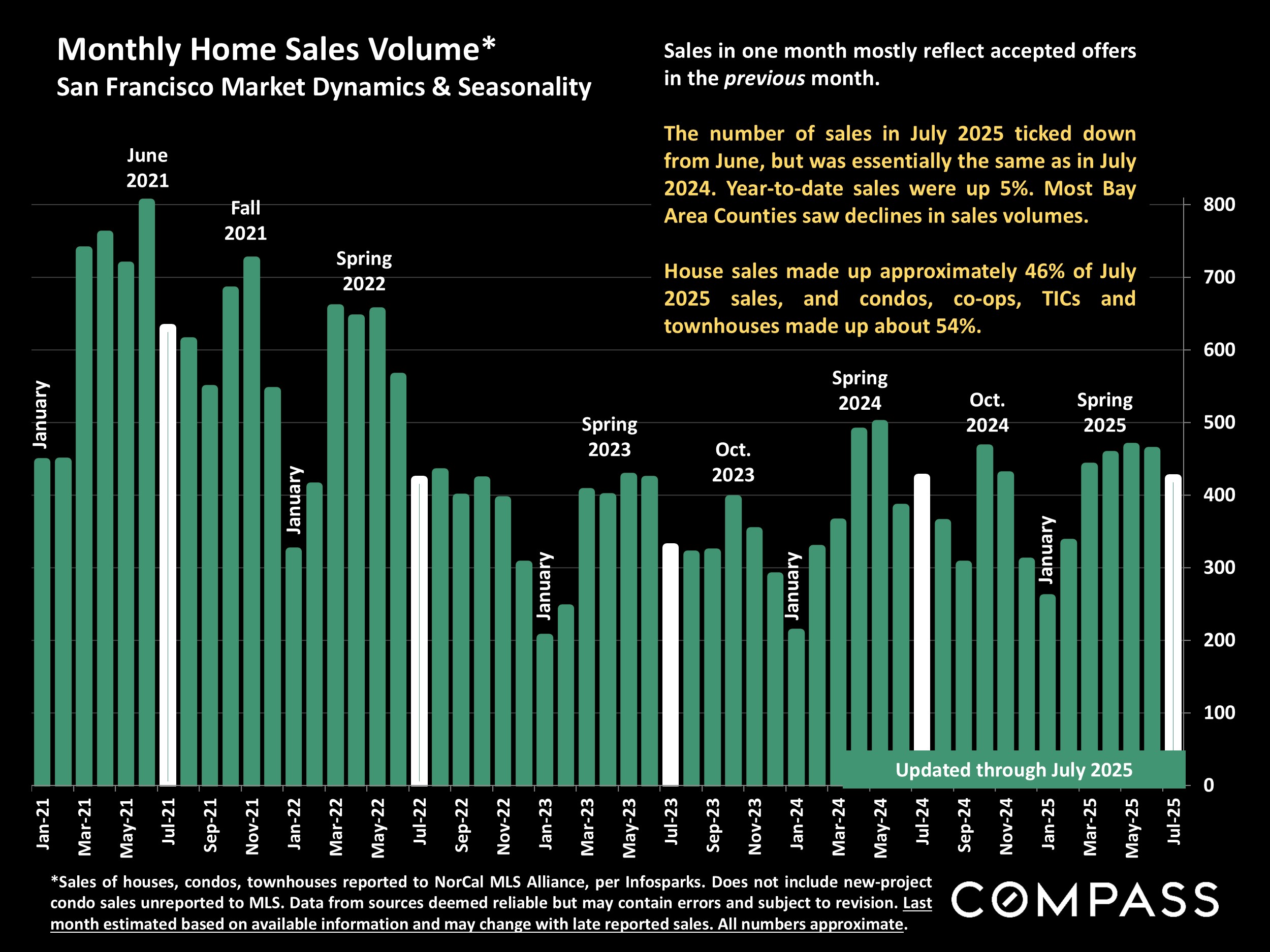

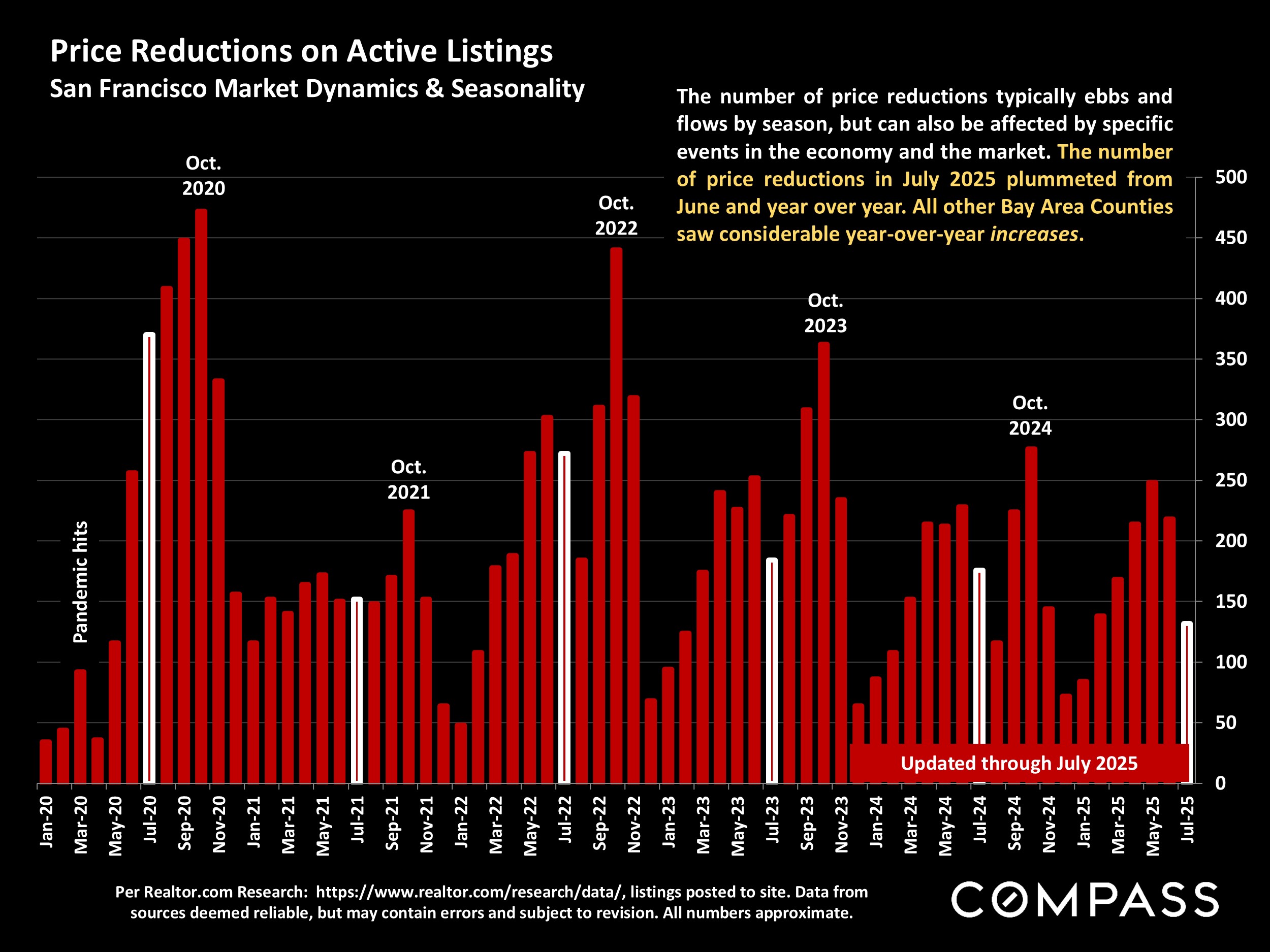

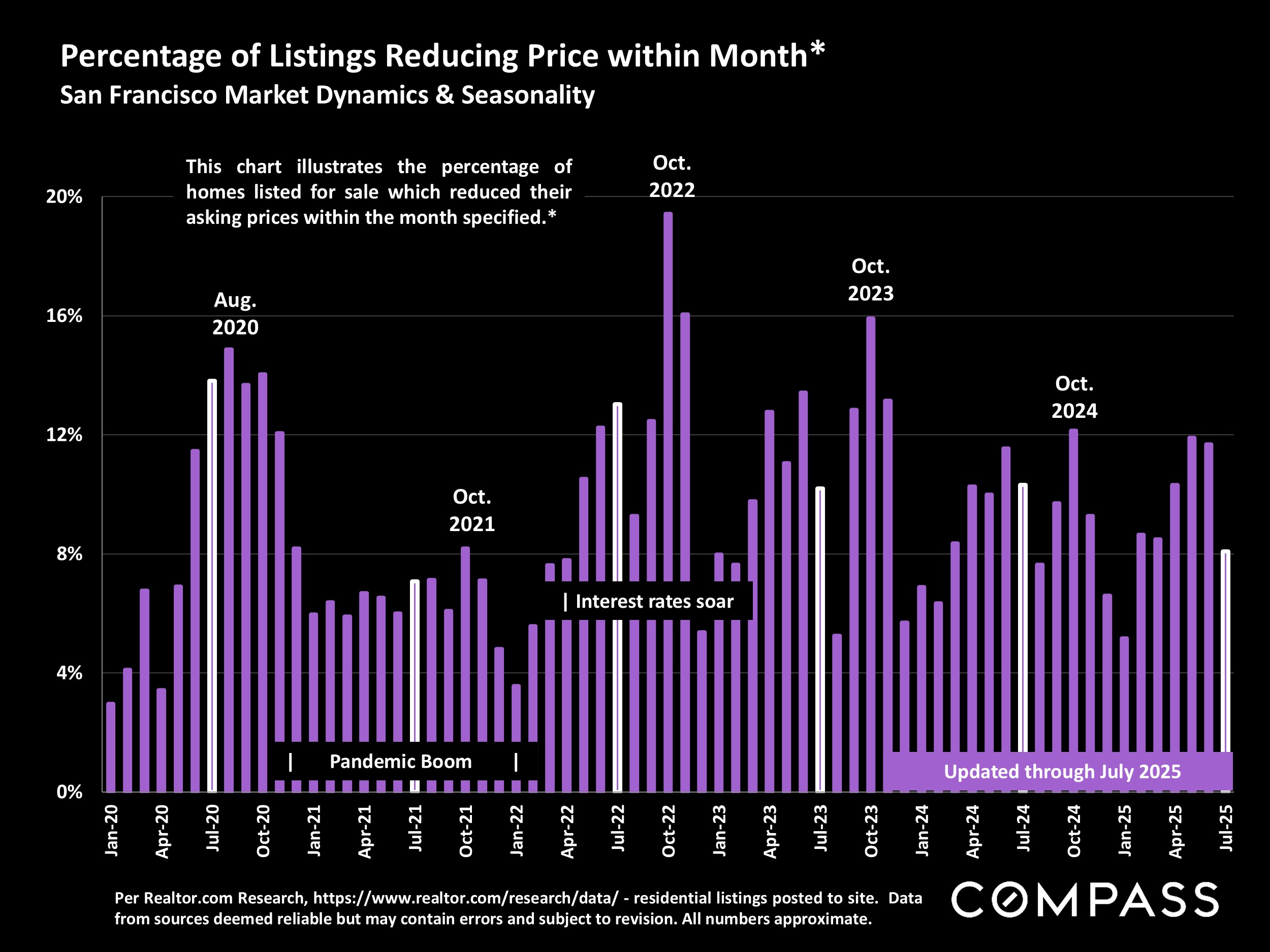

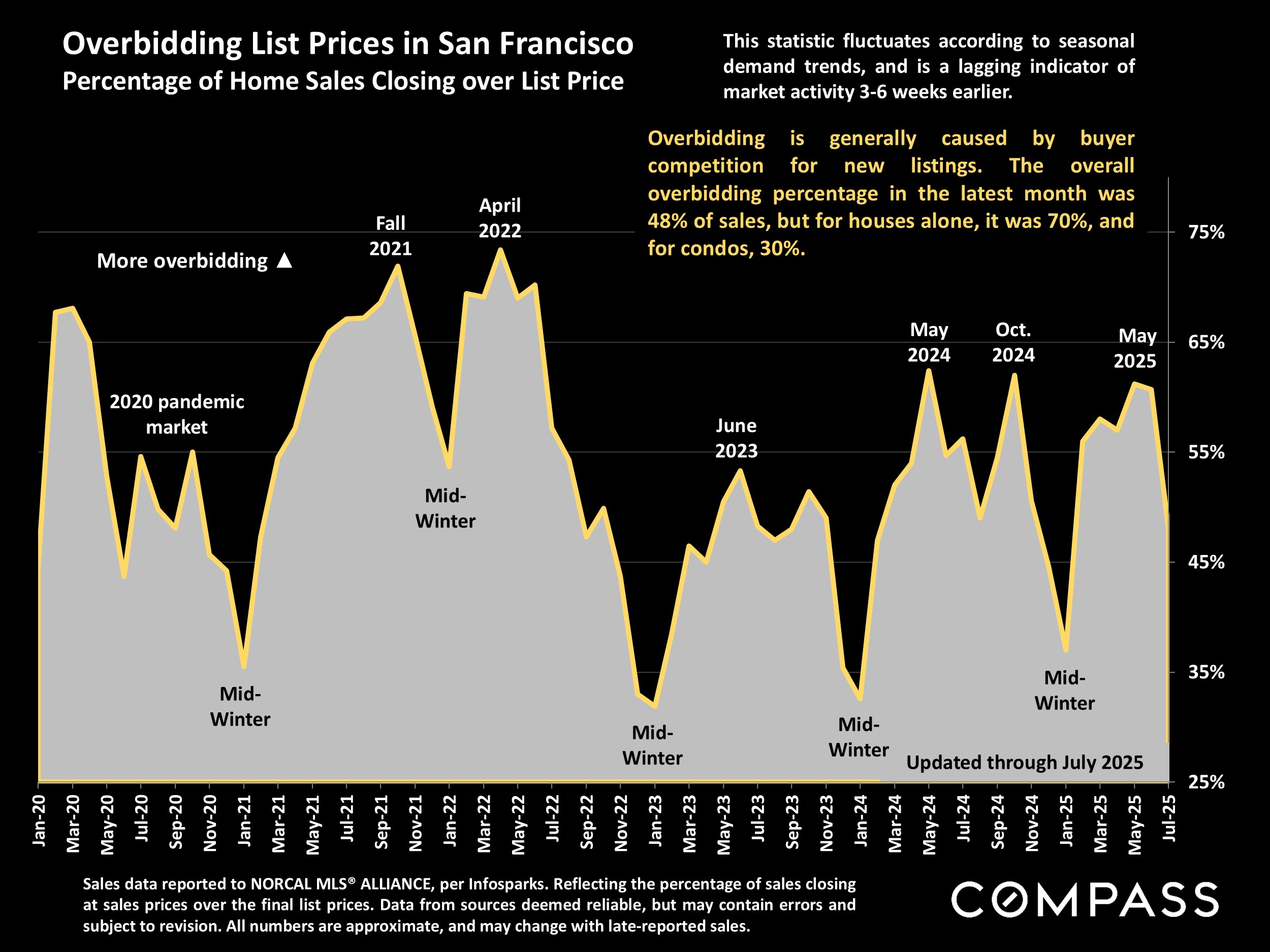

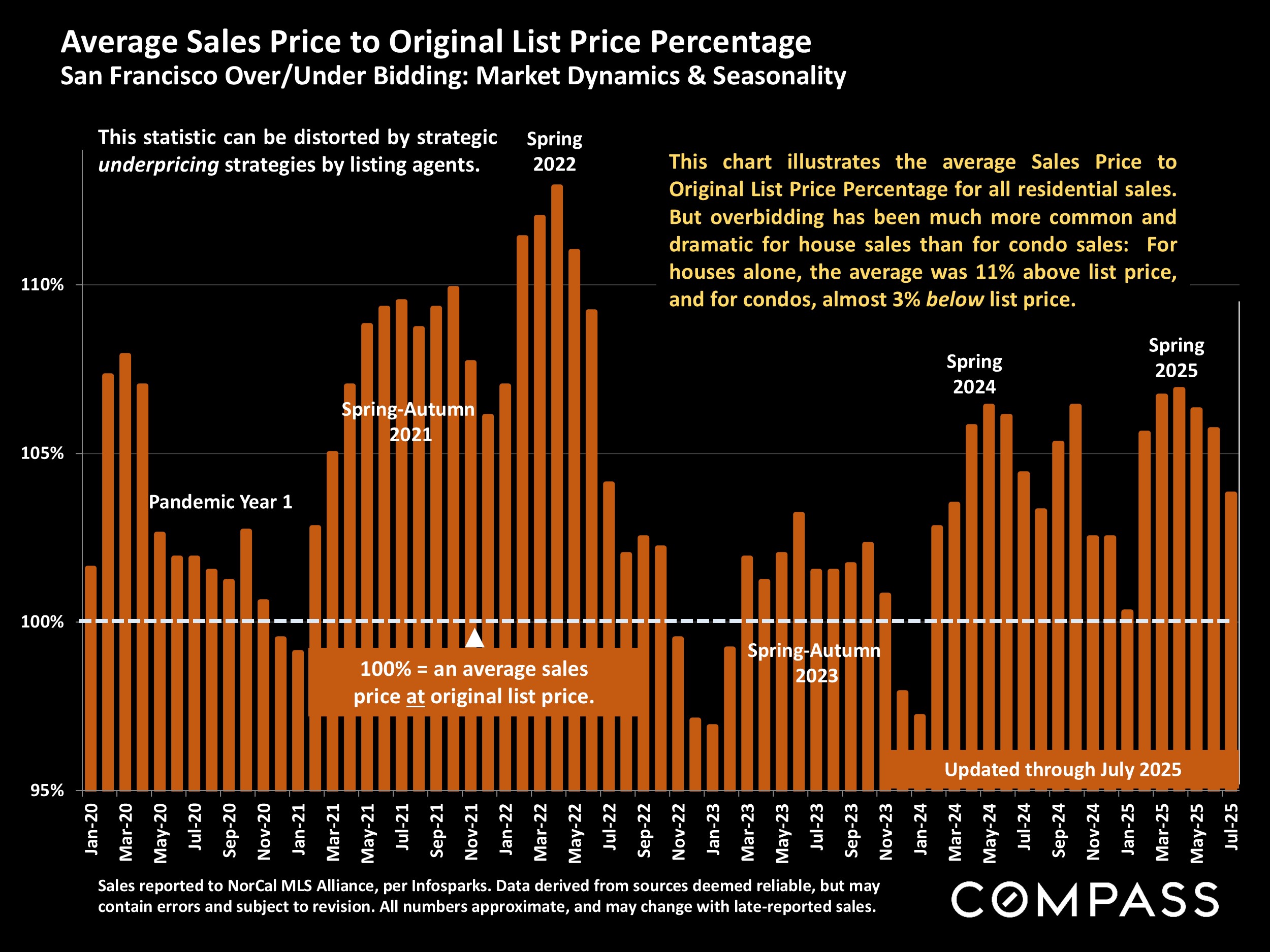

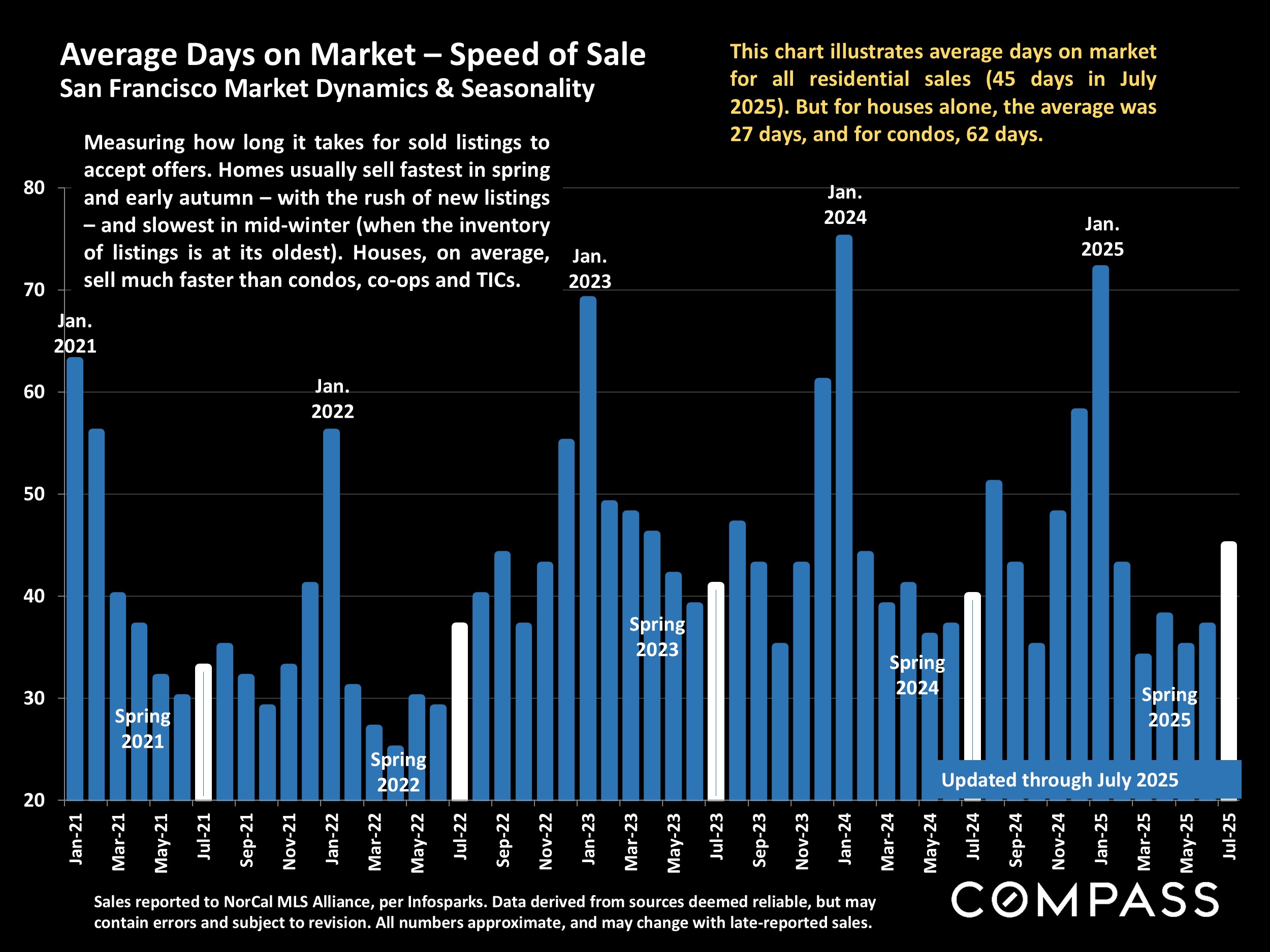

This has shifted the SF housing market into one of the strongest in the Bay Area, diverging from the cooling trends seen in most other counties and the country at large. Unlike most other markets, the supply of listings is dropping, price reductions are declining, and home prices are starting to climb year-over-year. And these are very early days for the Al boom in the city: If trends continue on course, hiring accelerates, startups grow, and privately held companies eventually move toward IPOs, the explosion of new wealth will likely be astounding.

Want to learn more about Bay Area market trends?

Let’s connect! With relationships and networks across the city, there are a variety of ways I can help you make informed real estate decisions. Call, email, or text – I’m here to help.

Contact