June 9, 2025

Marin: June 2025 Market Stats

By Compass

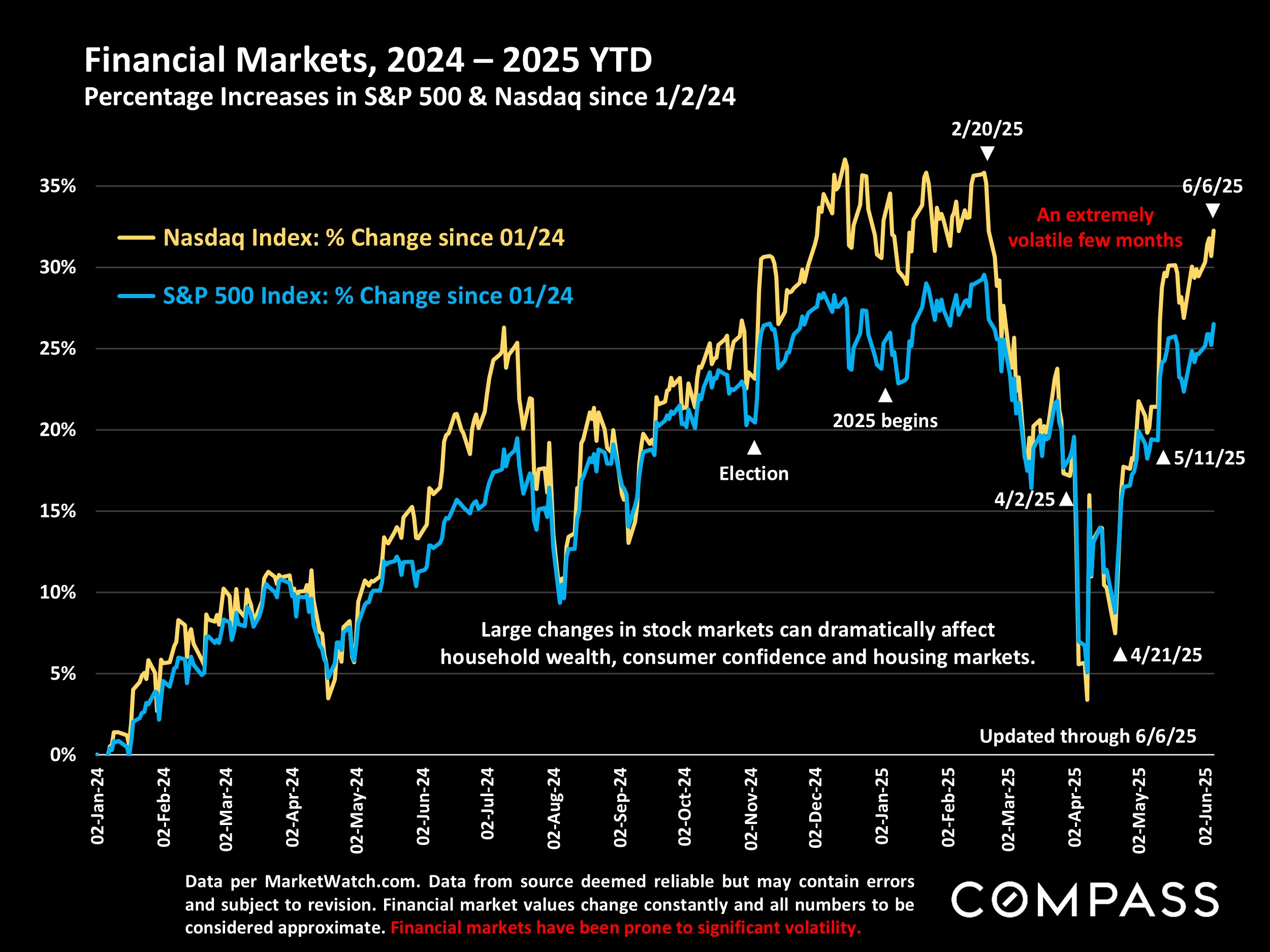

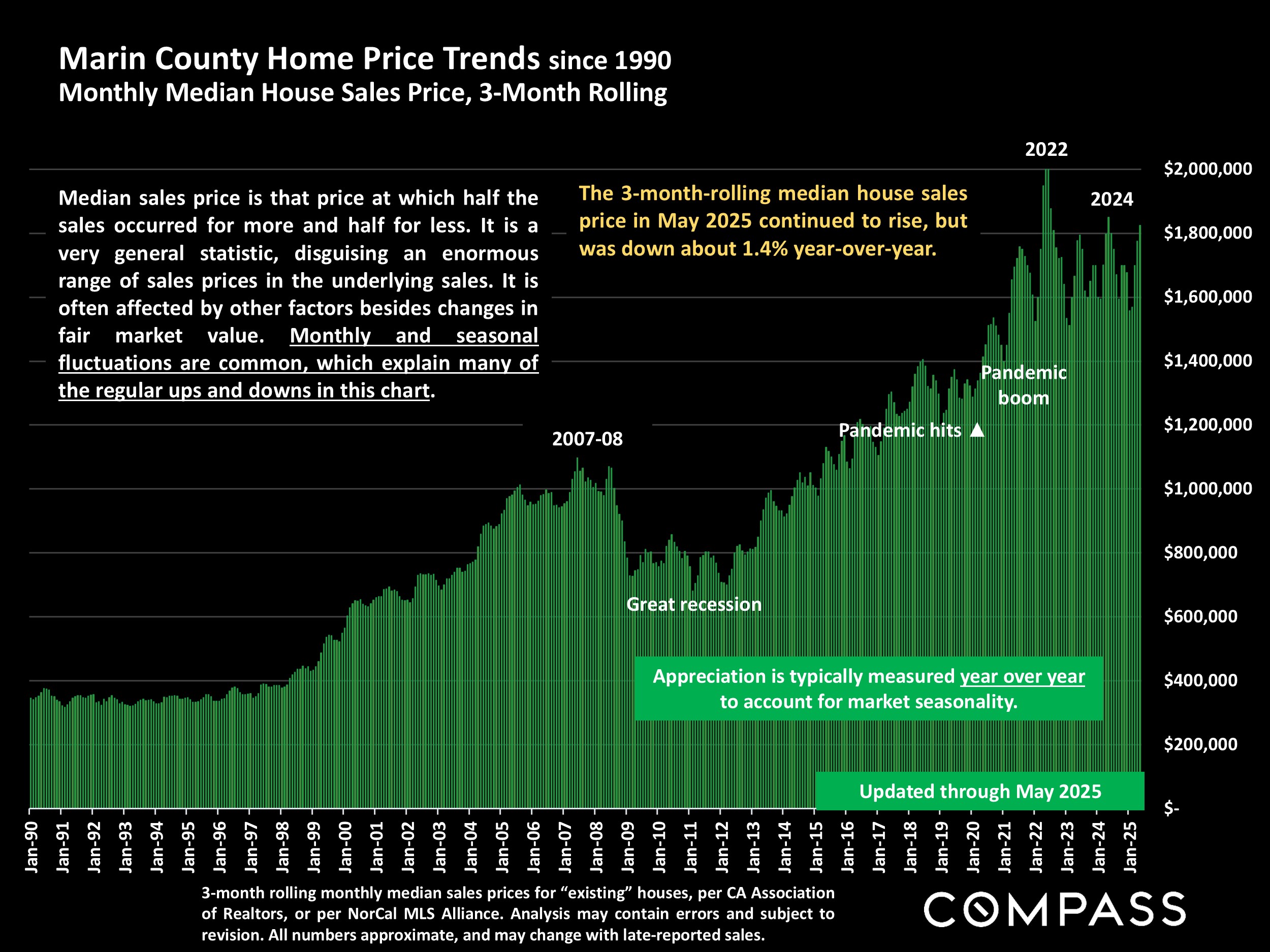

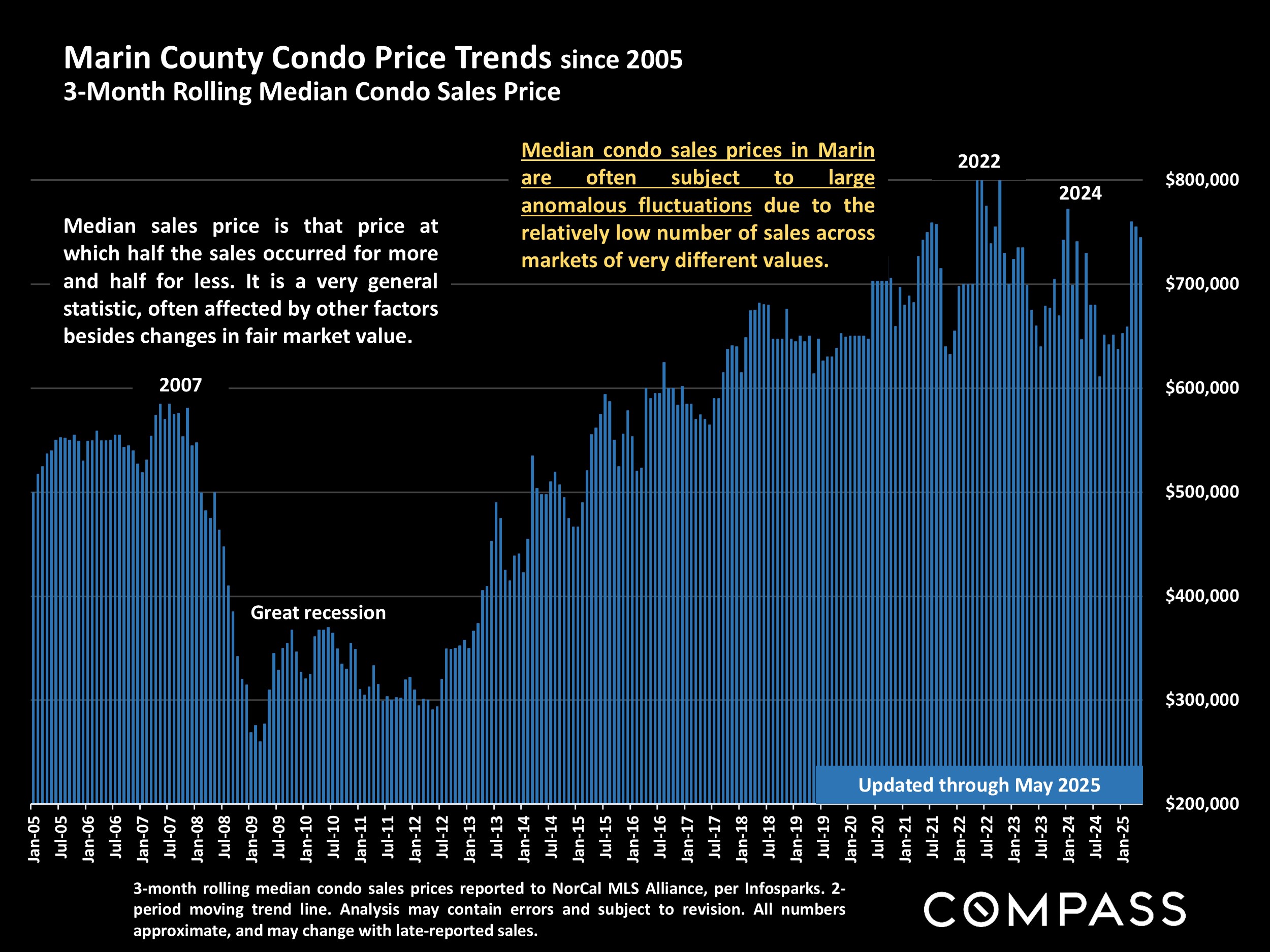

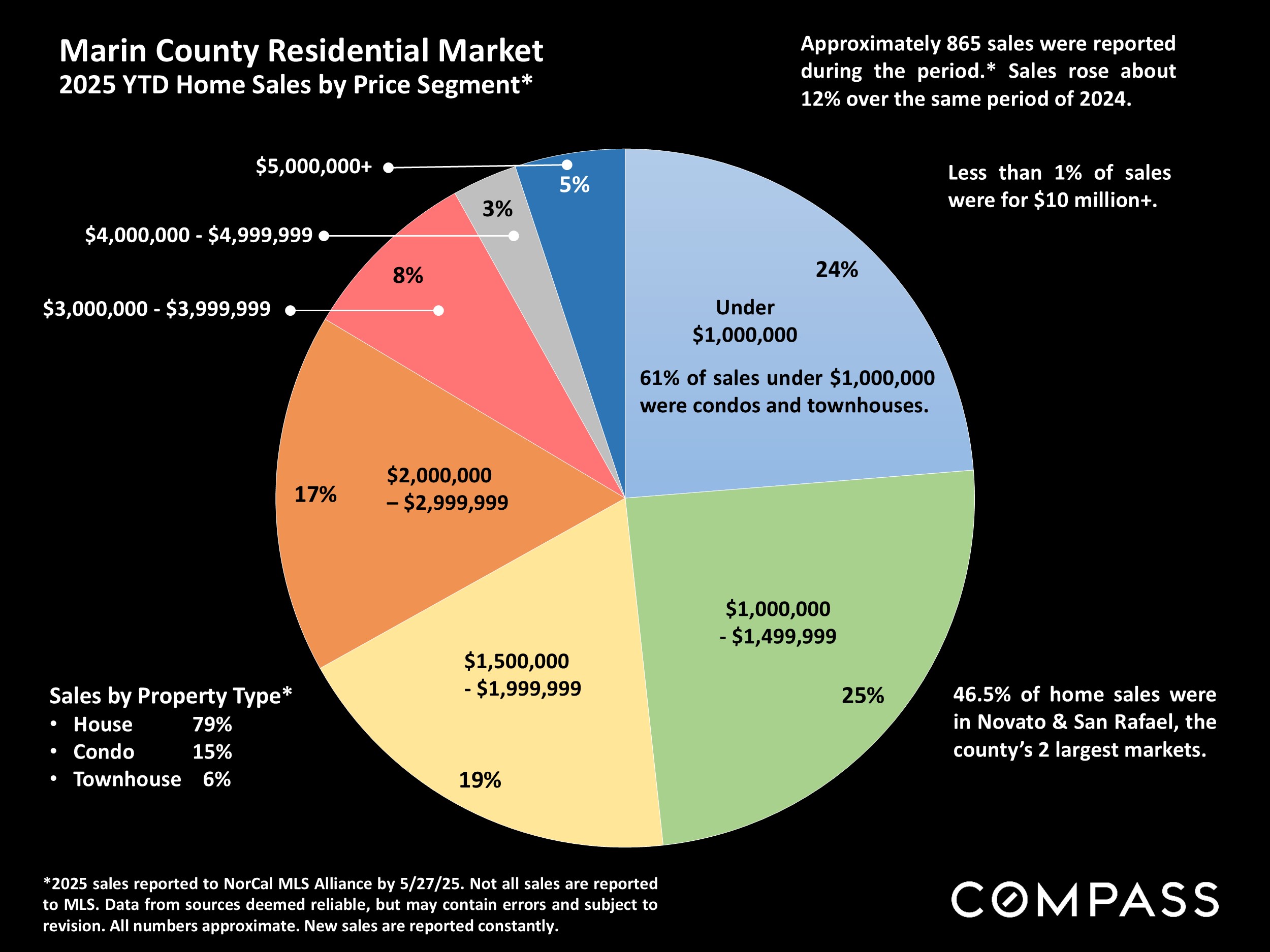

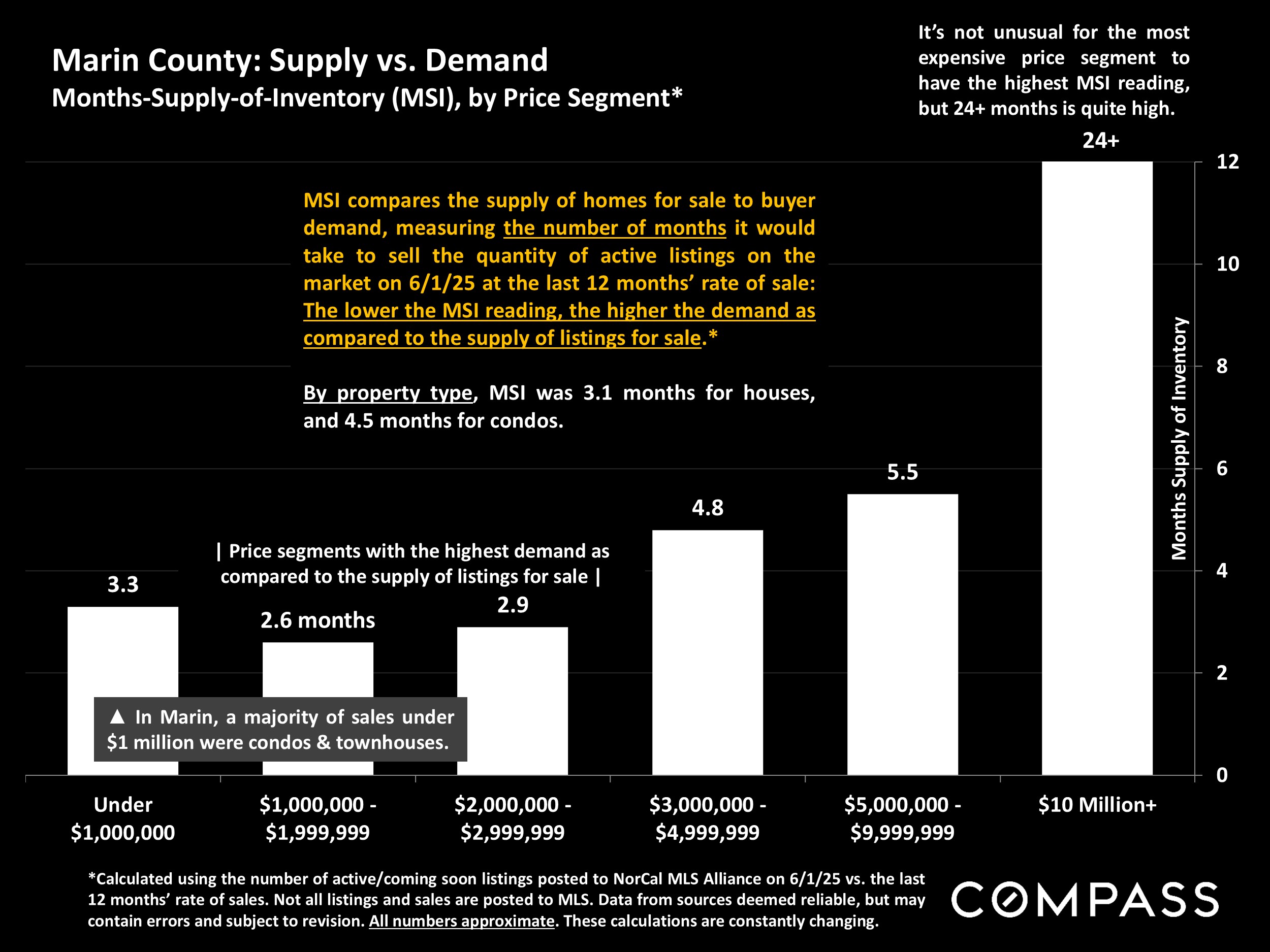

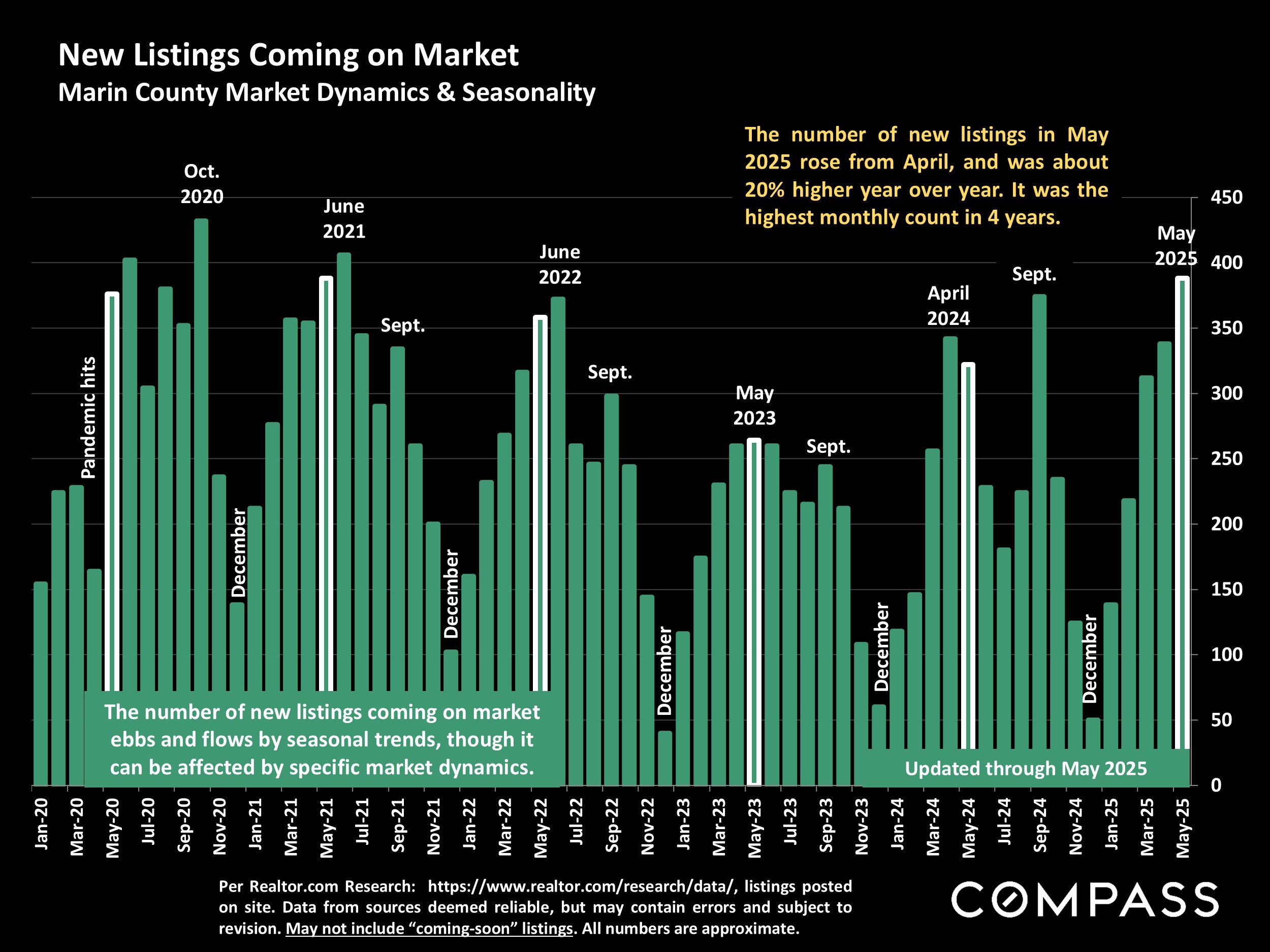

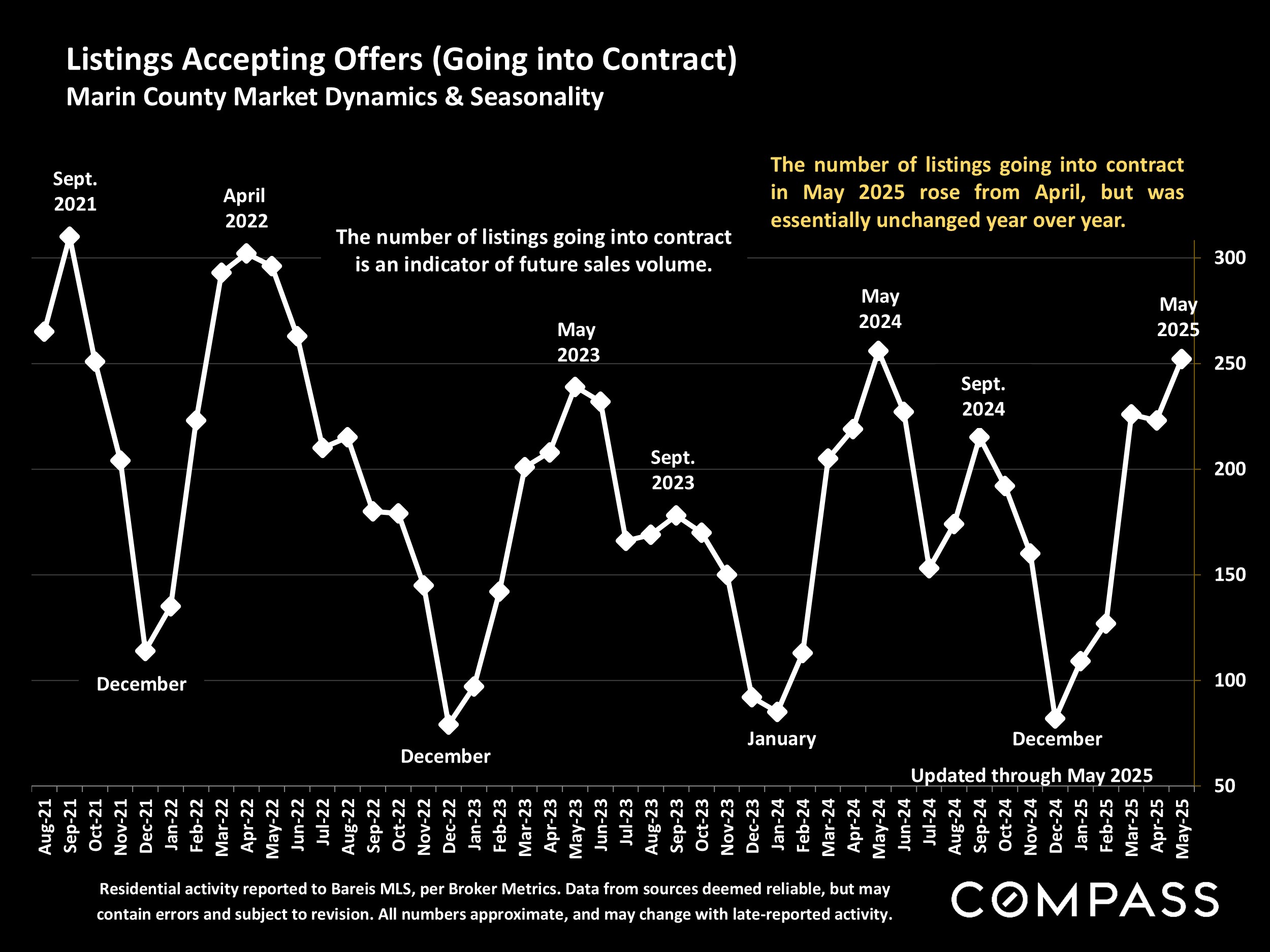

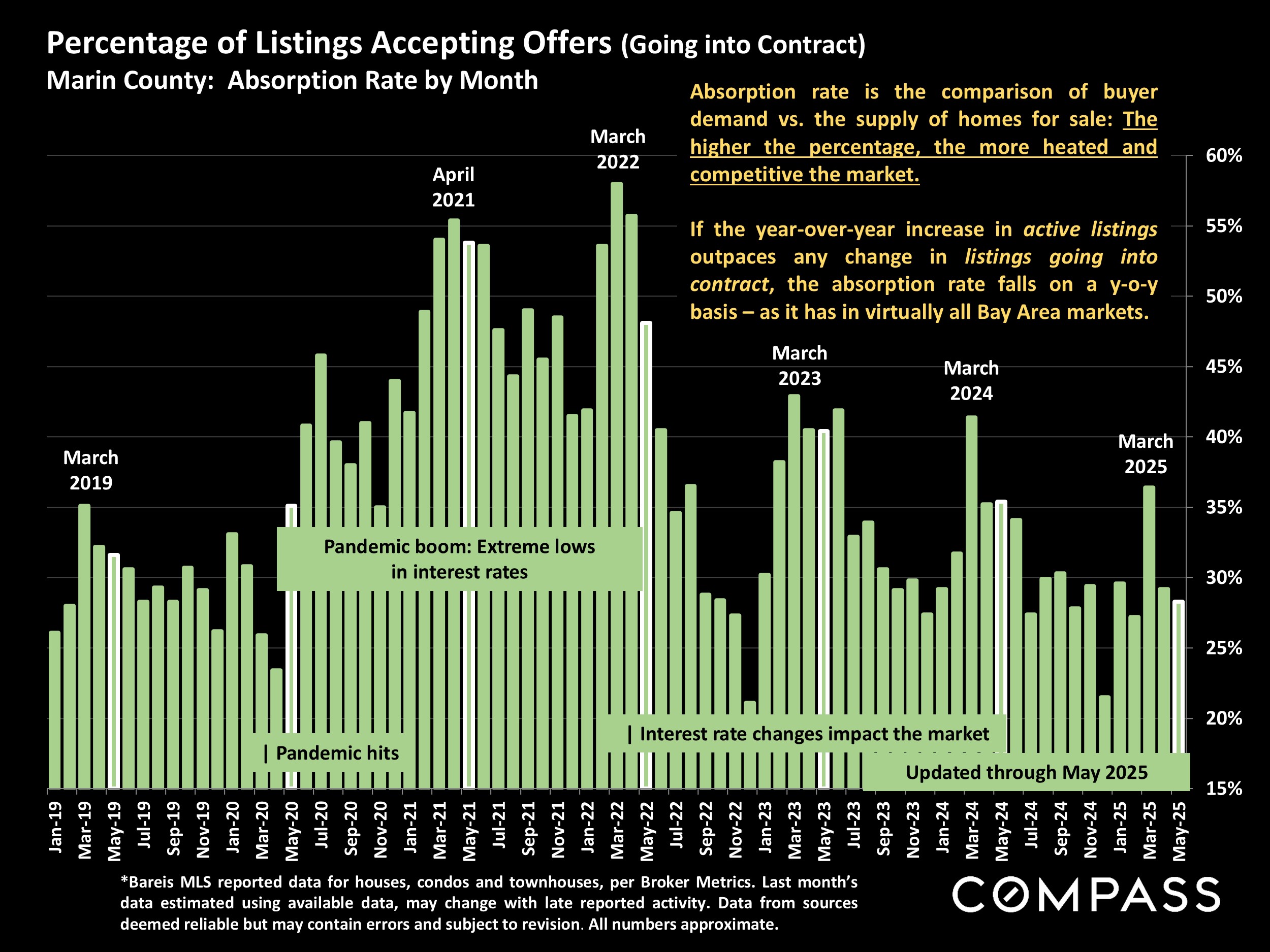

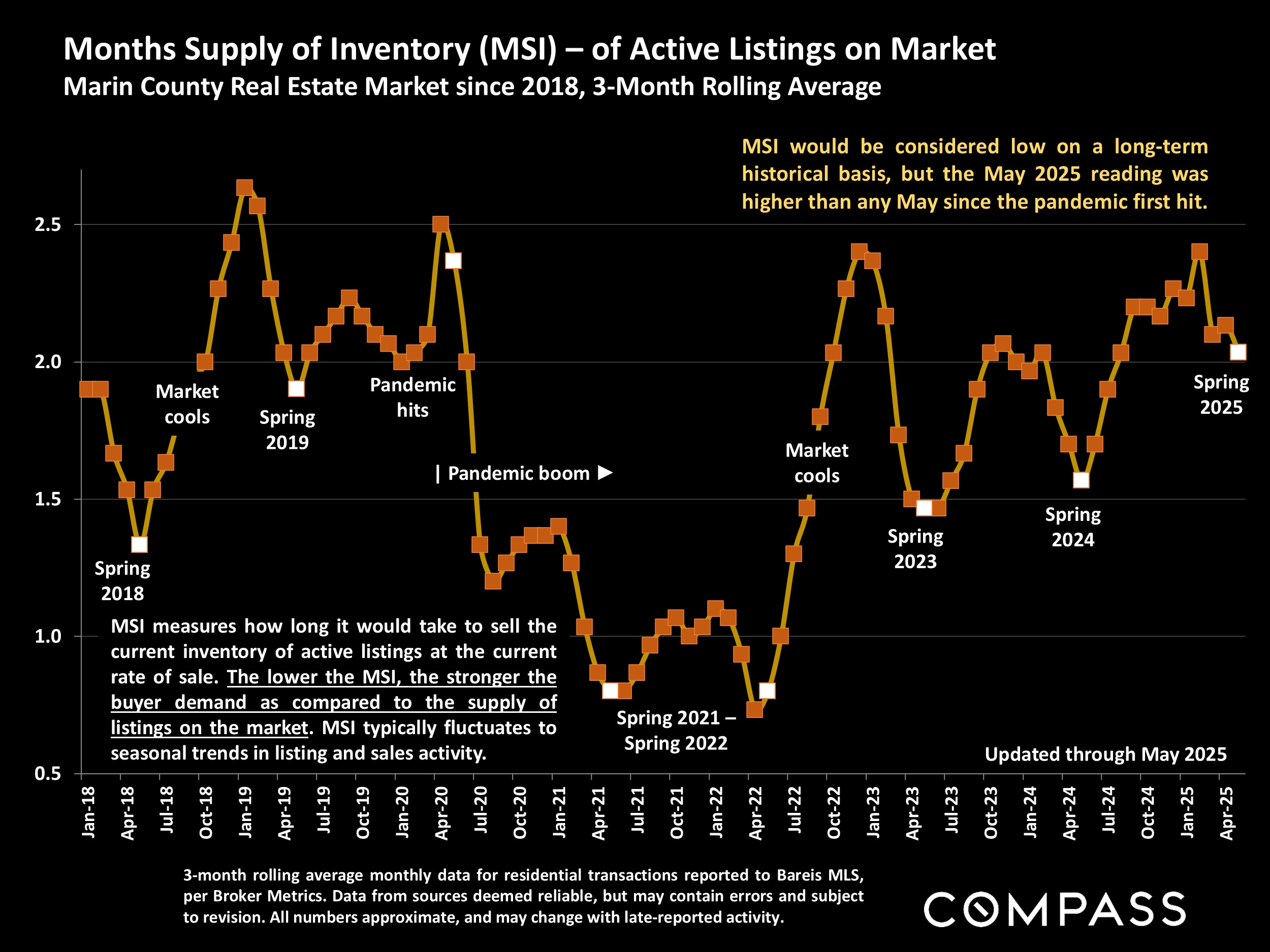

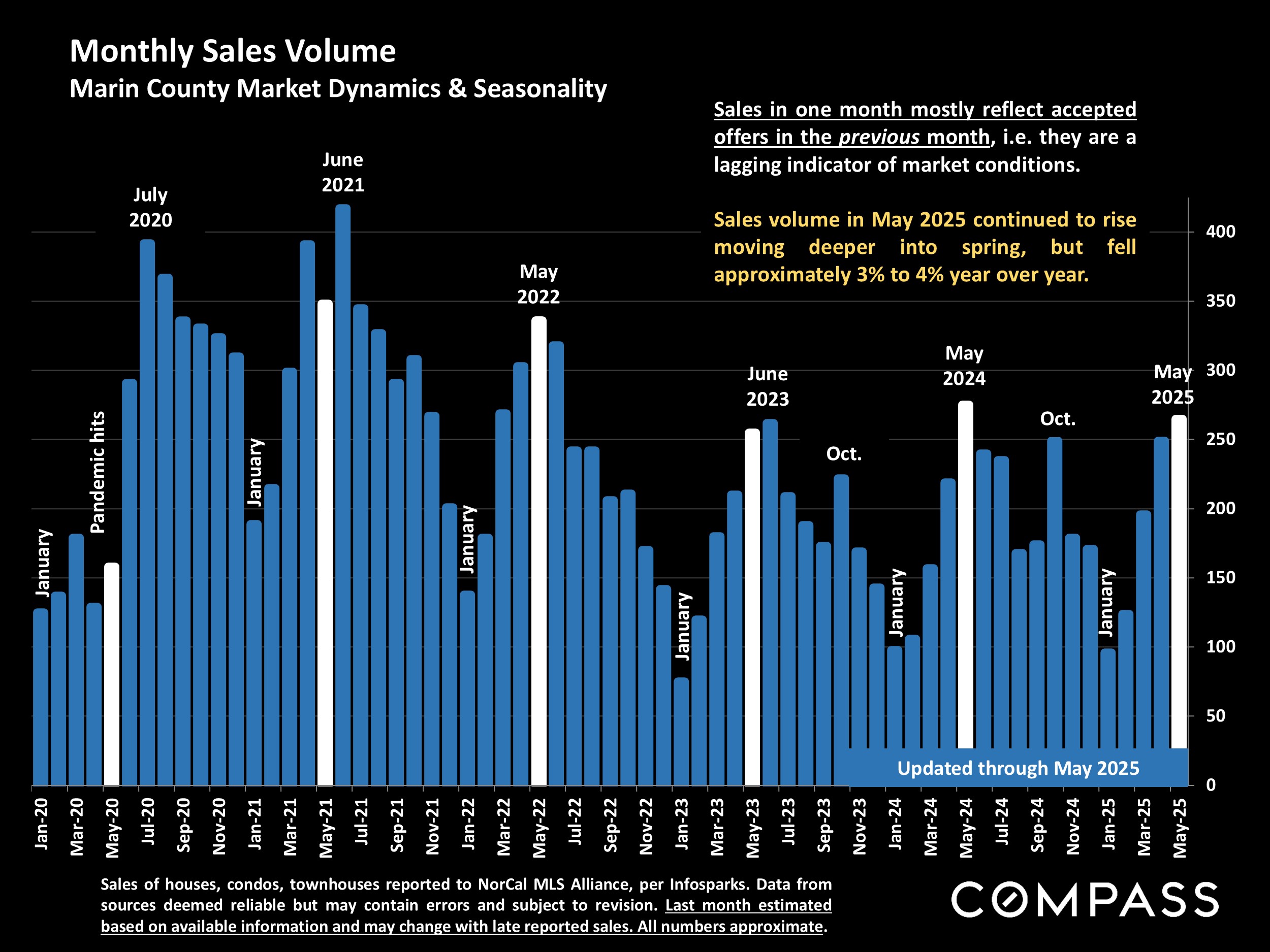

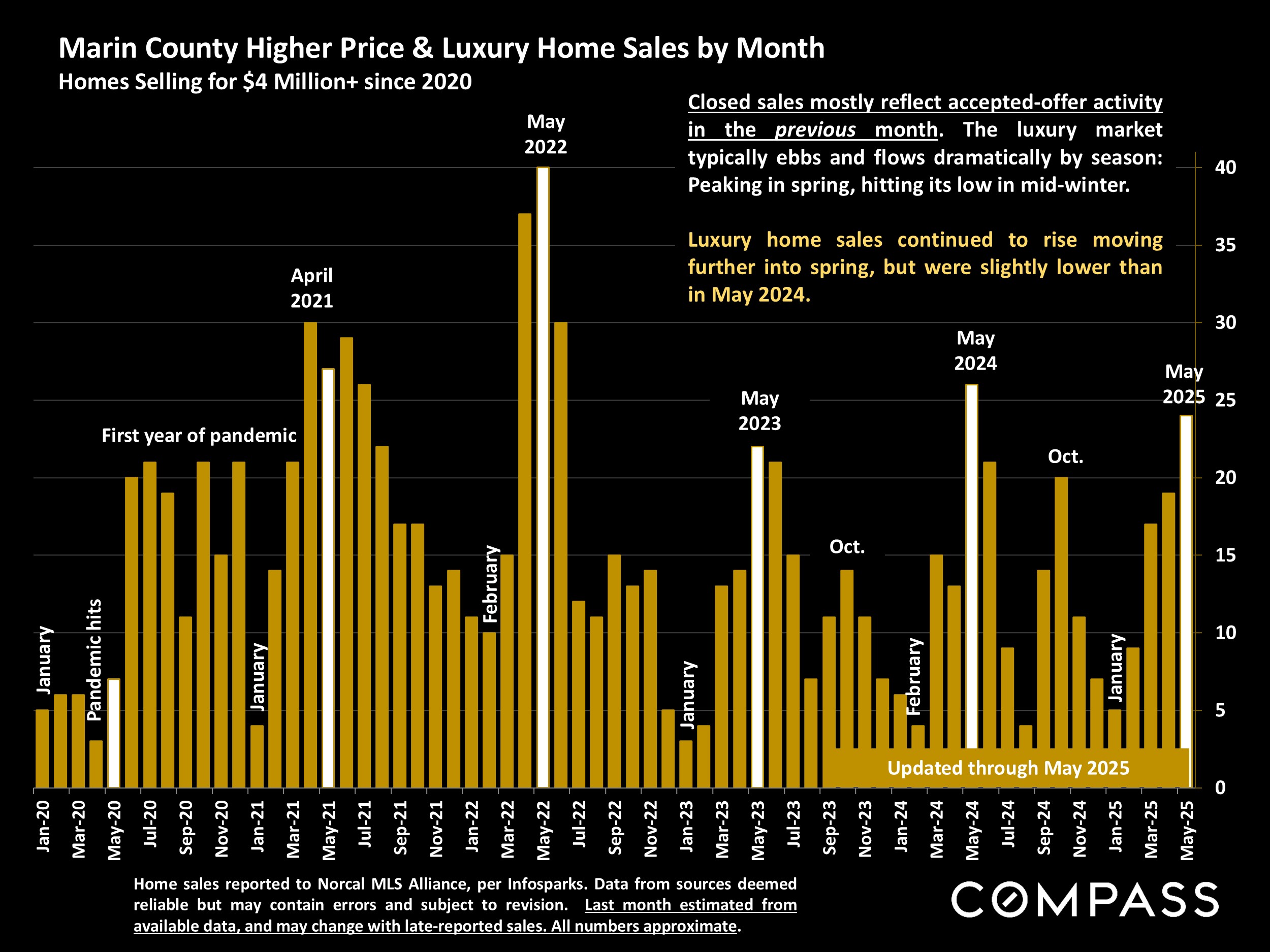

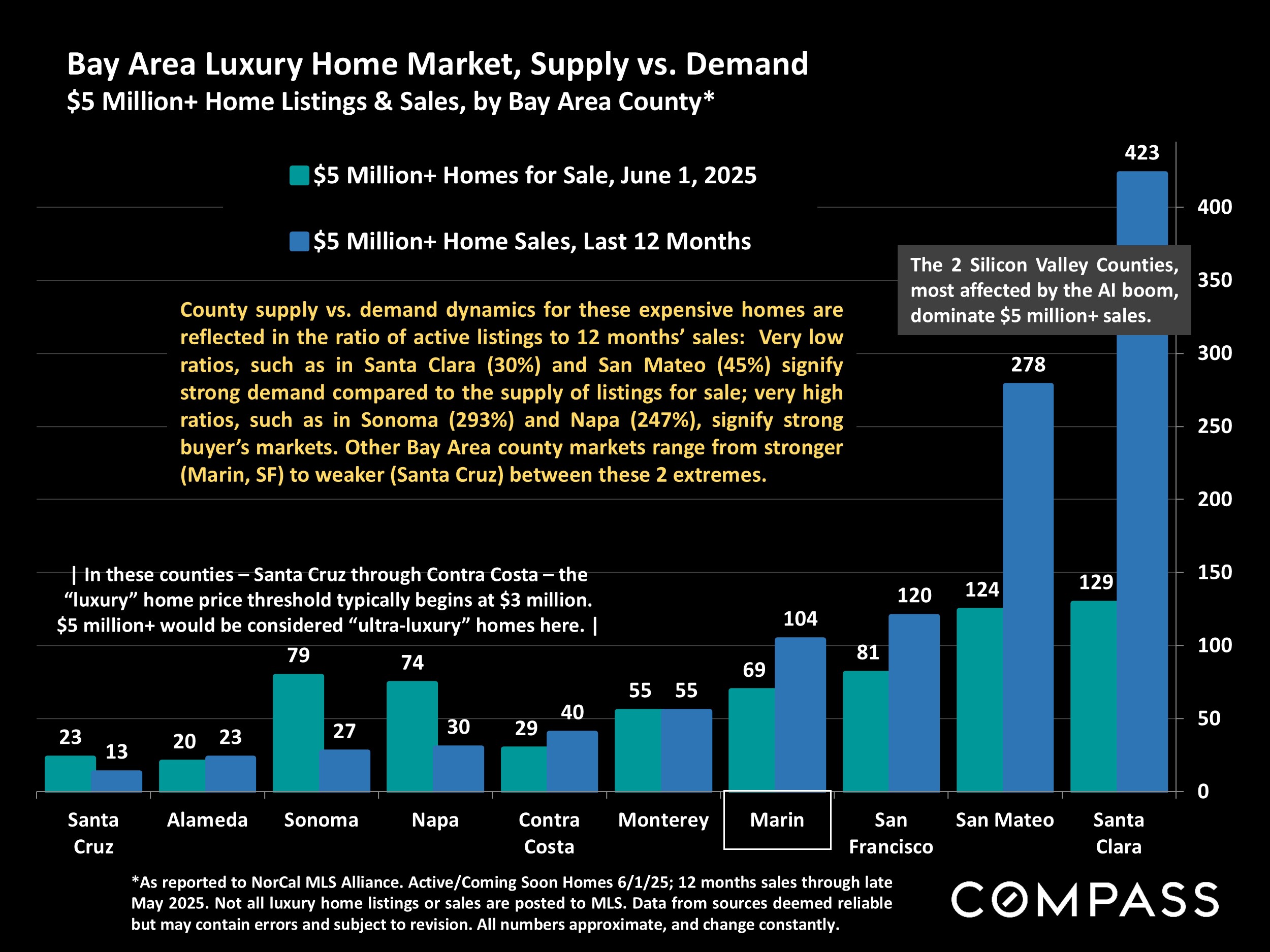

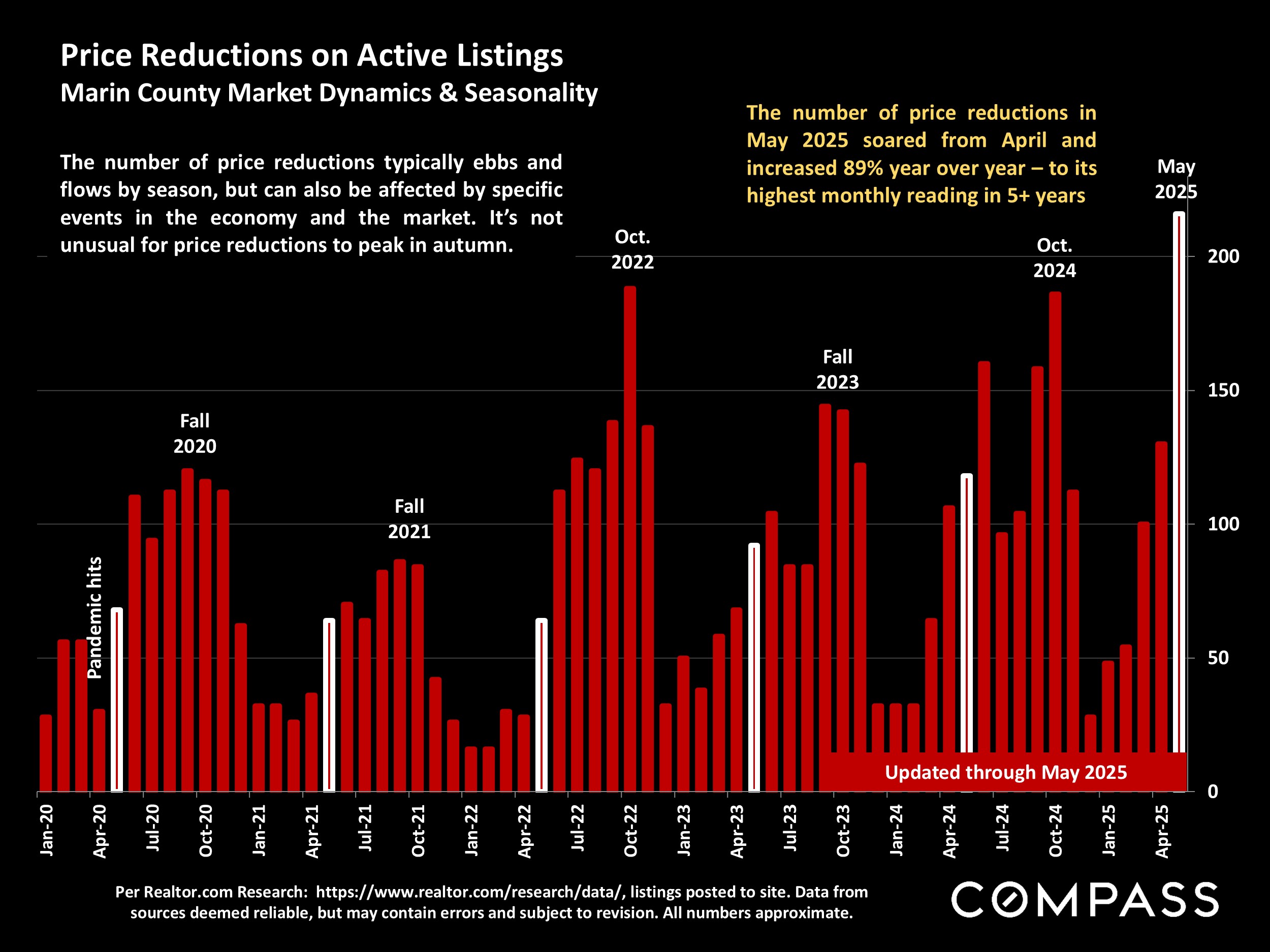

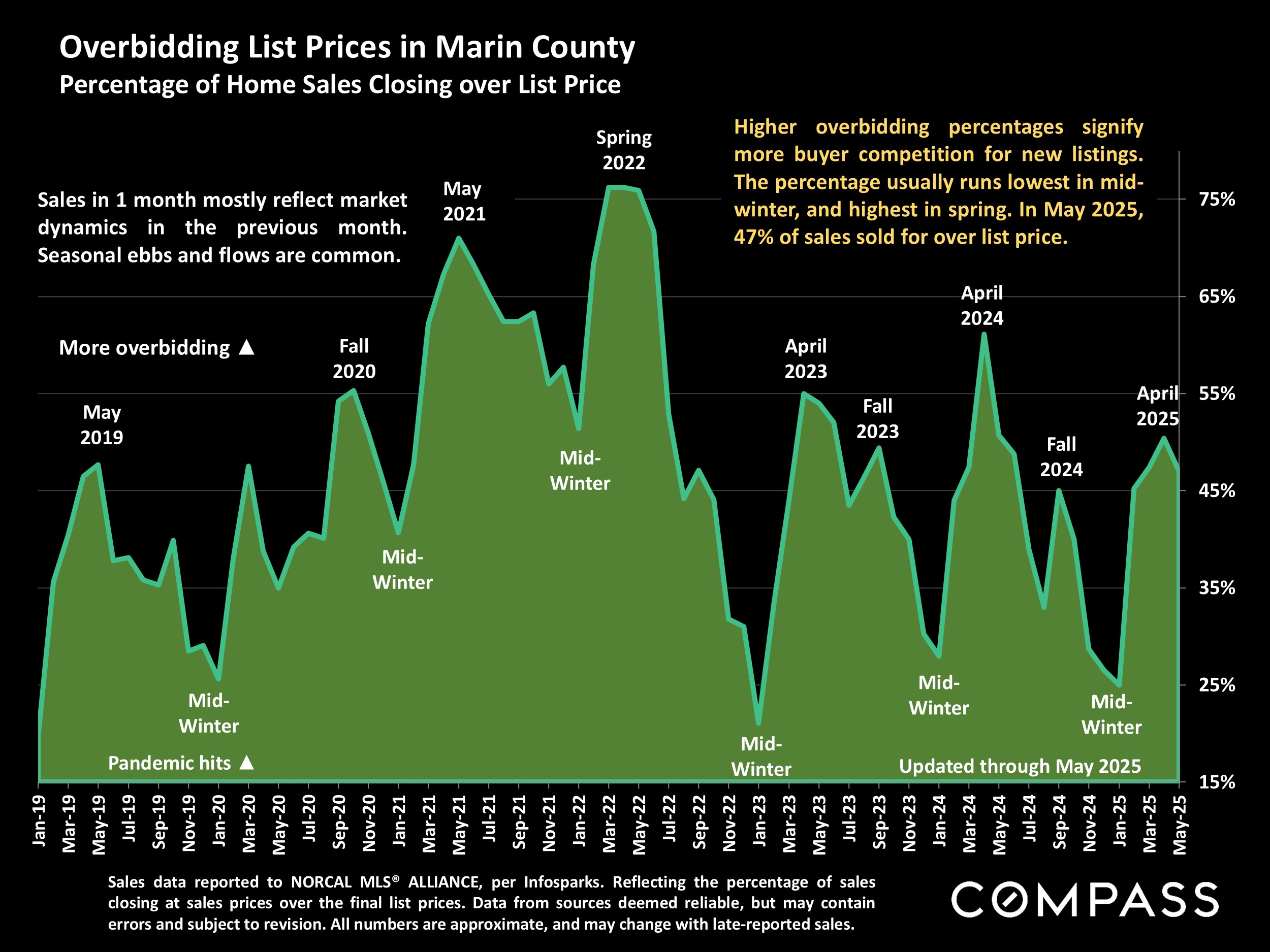

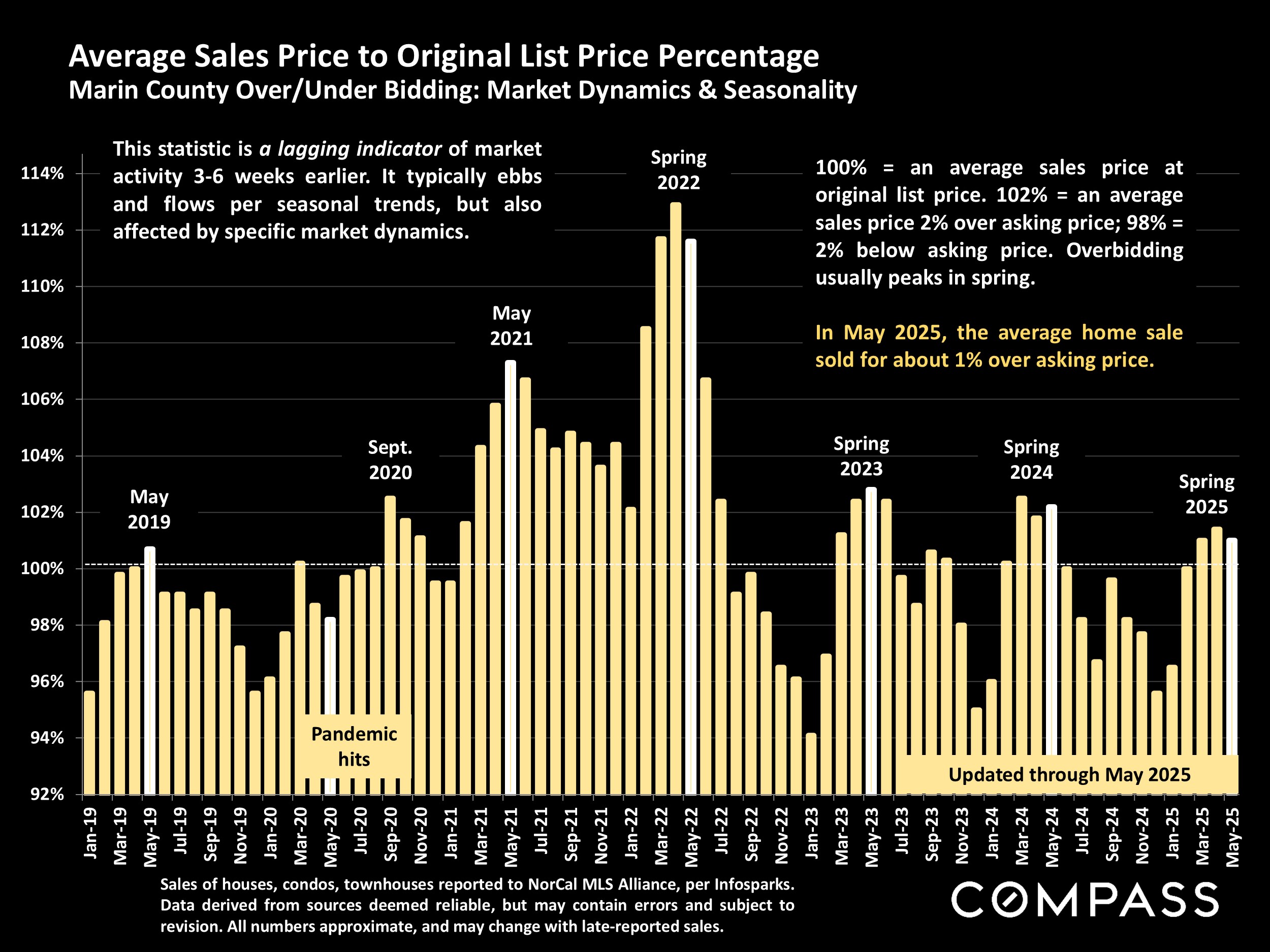

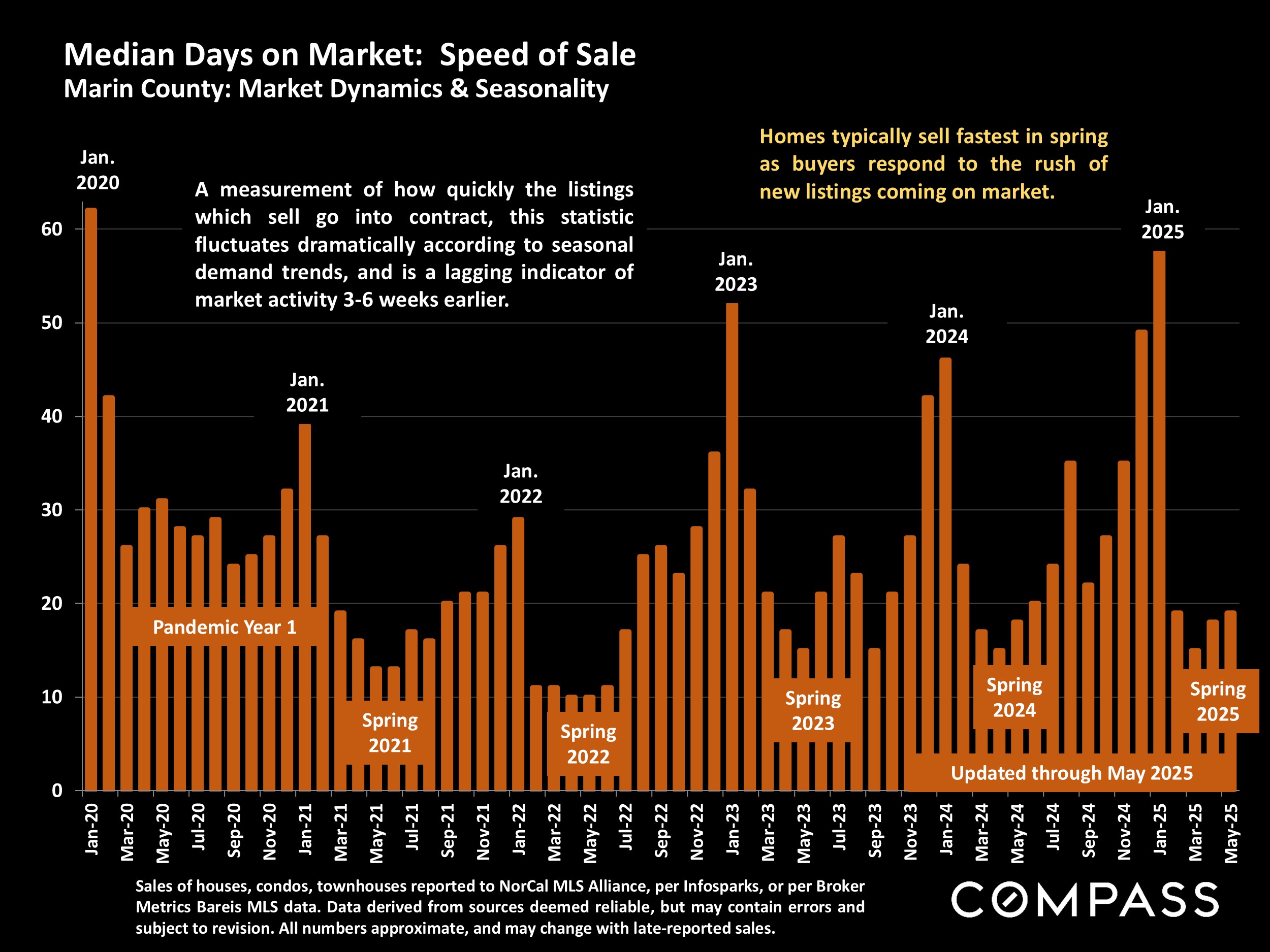

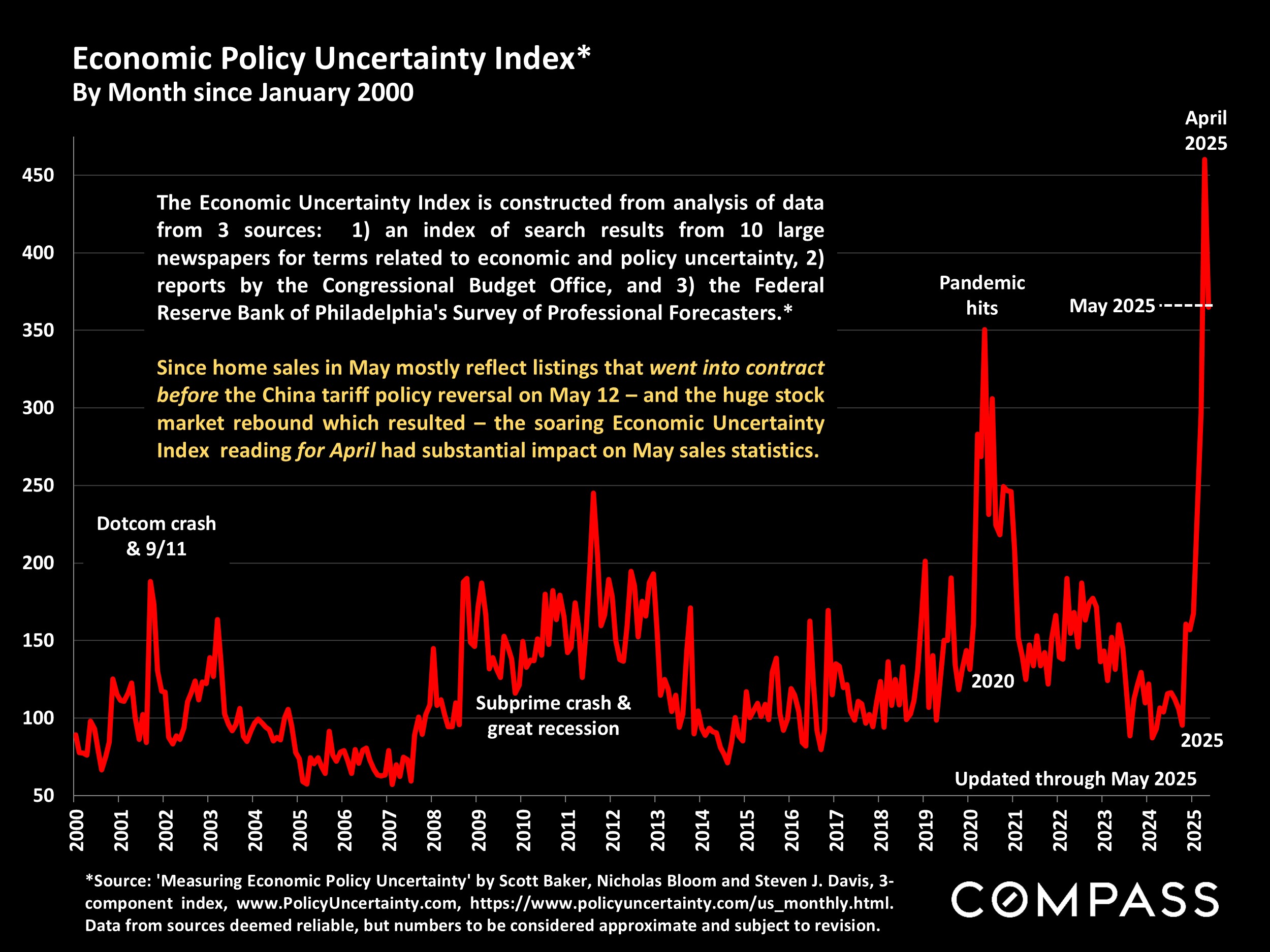

Ongoing volatility in political and economic conditions - particularly the plunge in stock markets in April, which affected May home sales - took some of the wind out of the spring real estate market, which is usually the most dynamic of the year. Uncertainty regarding the economy and the possible implications for personal financial circumstances understandably made a proportion of buyers and sellers hesitant about moving forward. Still, while most Bay Area markets slowed year over year, there was nothing approximating a crash. As inventory continued to rise, sales activity failed to keep pace, resulting in lower absorption rates (a comparison of demand vs. supply). With more homes for sale and somewhat less competition between buyers, overbidding declined, time-on-market ticked up, and price reductions increased. Most counties saw small year-over-year declines in their 3-month-rolling median home sales prices, but many homes still sold quickly for well over asking price.

It's worth noting that virtually all May sales were negotiated before the May 12 reversal of China-tariff policies, which triggered an enormous rebound in the stock market. Unlike stocks, home sales don't reflect shifts in market conditions instantly - there is typically a 3 to 6-week lag between offer acceptance and close of sale - and there are indications that the effects of April's negative economic gyrations on buyer and seller psychology may already be fading.

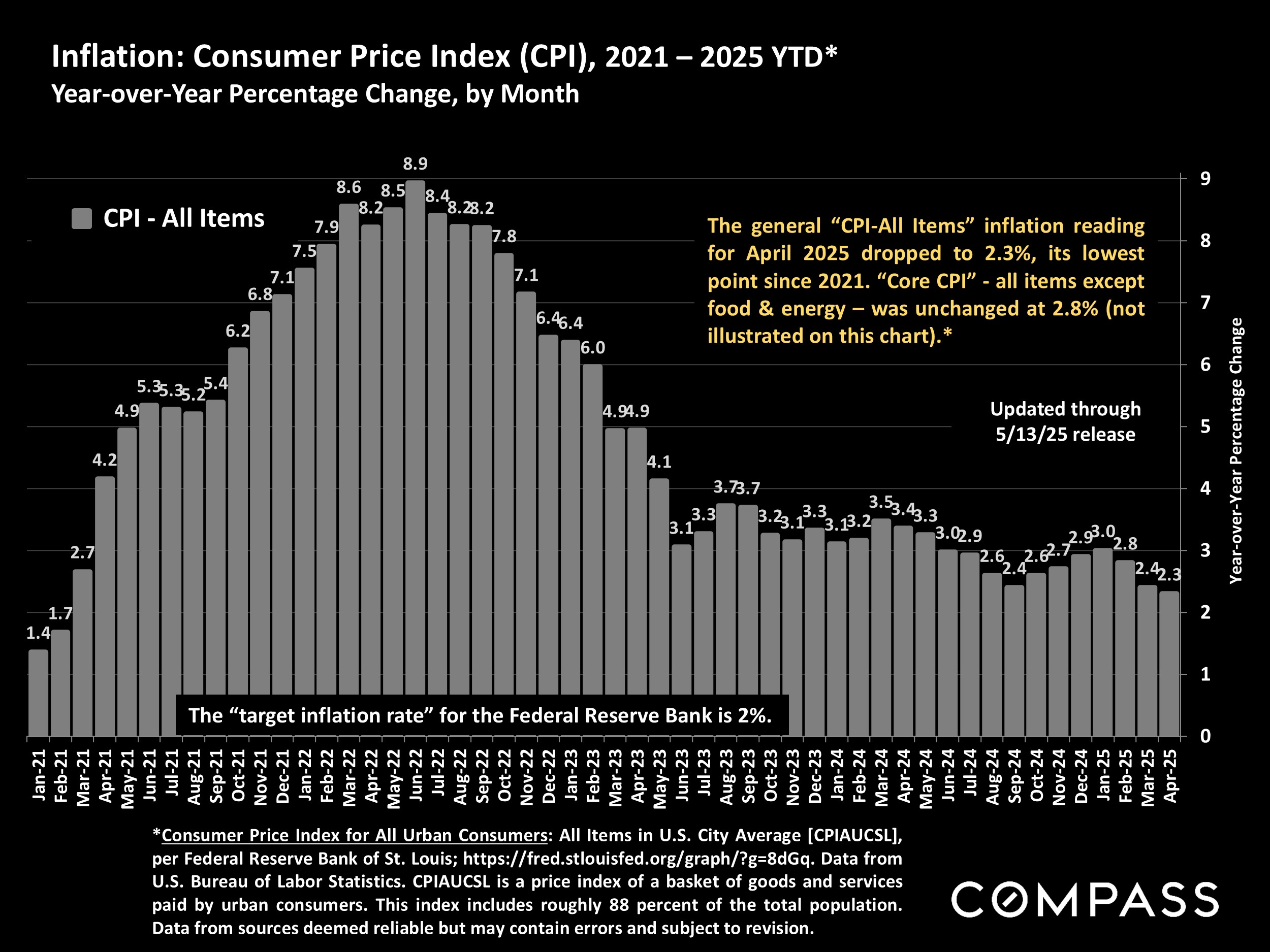

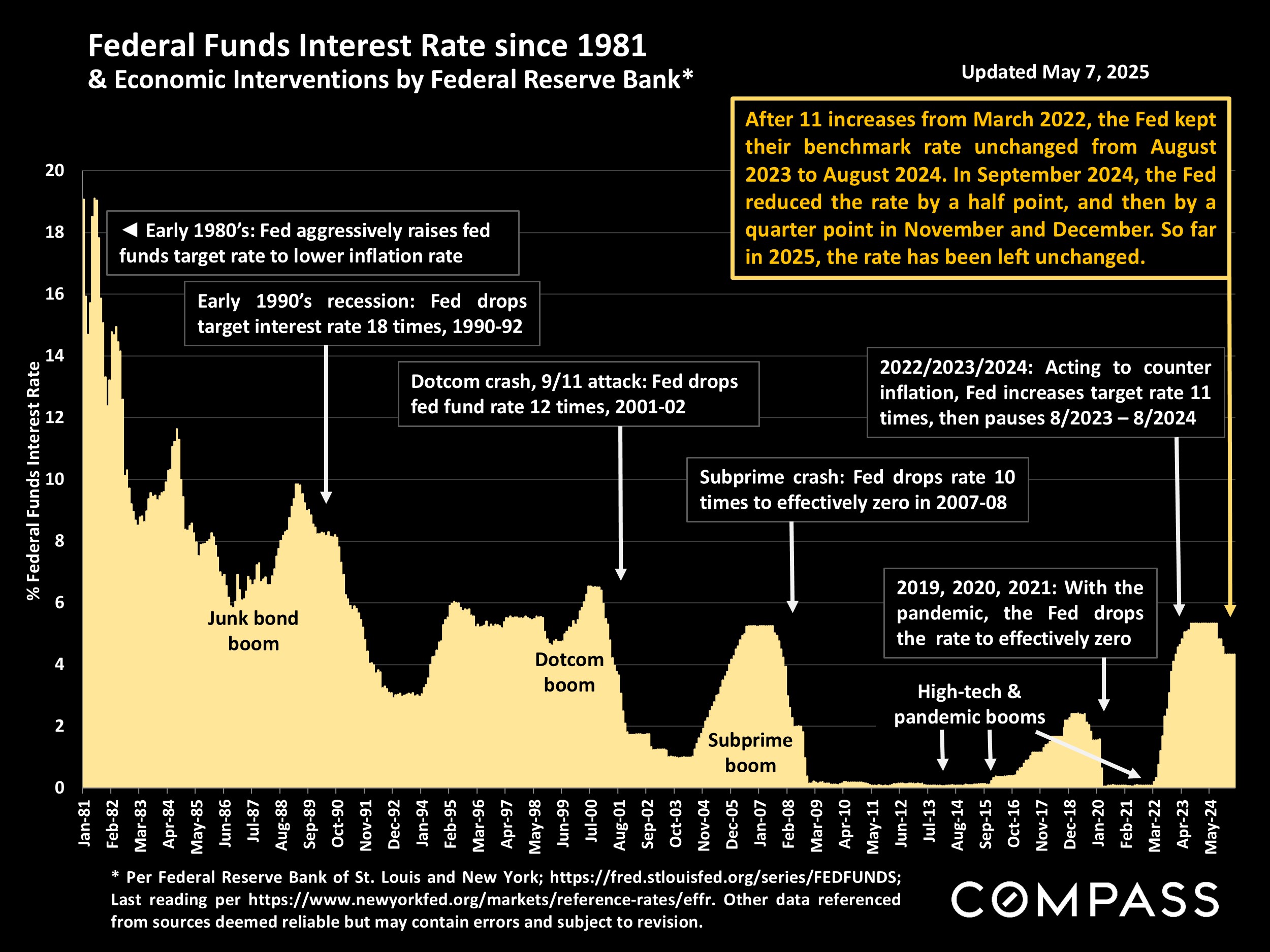

The speed and scale of developments in 2025 - tariffs, stock markets, inflation, interest rates, consumer confidence, tax law, national debt concerns, international relations, what the Fed decides, and so on - have made it challenging for real estate market reports to keep up.

As always, real estate trends vary locally. The rest of this report focuses on the specifics of the Marin County market.

Want to learn more about Bay Area market trends?

Let’s connect! With relationships and networks across the city, there are a variety of ways I can help you make informed real estate decisions. Call, email, or text – I’m here to help.

Contact